'They're going to fall off a cliff': August set to bring new financial anguish as coronavirus aid lifelines expire

For the millions of Americans pushed out of work by the COVID-19 crisis, revamped unemployment insurance has been a lifeline -- helping provide food and necessities while their places of business remain shuttered or downsized.

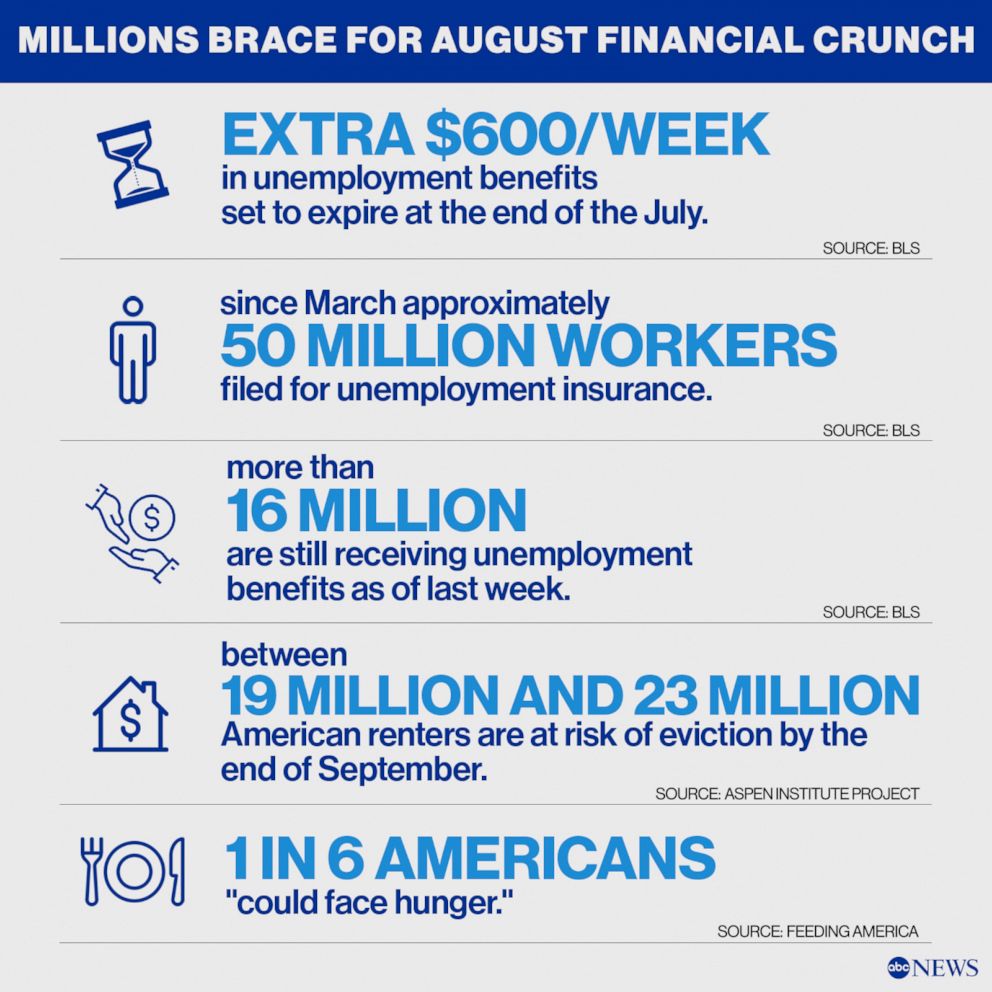

The checks -- $600 a week in addition to any other benefits -- were in many cases sizable in comparison to what they would normally receive from their state unemployment offices.

And while the process was fraught, many people who would have been ineligible for benefits, including independent contractors and small business owners, were able to get needed help amid mandatory shutdowns to stem the tide of the virus.

Businesses received grants and loans from the federal government to float payrolls and pay bills, keeping workers on the rolls and allowing some business to rehire those who were laid off or furloughed.

And a series of eviction and foreclosure moratoria scattered throughout the nation have also kept many from being homeless as the pandemic and ensuing economic calamity rages.

At the end of the month, however, many of these pandemic aid programs will dry up at once.

So when August hits, some economists are predicting an onslaught of new financial anguish and a tidal wave of evictions.

' They're going to fall off a cliff': Extra $600 a week lifeline severed at the end of July

At the end of the month, the extra $600 a week in unemployment insurance instituted through the CARES Act will expire -- and right now, it seems unlikely Congress will pass an extension before then.

"The people who are unemployed and getting $600, they're going to fall off a cliff," Michele Evermore, a senior policy analyst at the National Employment Law Project, told ABC News. "The median benefit in a state like Mississippi is around $212 a week. In Arizona, the maximum benefit is $240 a week. So people are going to go from $840 to $240 overnight."

Approximately 50 million workers filed for unemployment insurance since March, and more than 16 million are still receiving unemployment benefits as of last week.

"Obviously, we remain very much in the thick of this economic downturn and to the extent that we've gotten very little improvement in new claims for unemployment benefits," Mark Hamrick, Bankrate's senior economic analyst, told ABC News.

The extra $600 a week is "critically important," Hamrick added, as "many Americans were hanging on by a thread coming into this crisis to the extent that they were living paycheck to paycheck."

The end of this aid "obviously causes real stress, and that translates to the risk that people aren't even able to put food on the table," he added.

"Ultimately, this is a humanitarian crisis," he said. "When you see lines clogging highways of people obviously in need of access to food."

As a result of the pandemic, the nonprofit food bank network Feeding America estimates one in six Americans "could face hunger."

At a macroeconomic level, the extra $600 a week has also stimulated the economy, pumping in billions of dollars in spending that otherwise would not be there. Yanking that away could have a devastating impact on consumer spending and demand, hurting the economy at large, Hamrick argues.

"The extent that this extra $600 has helped spending at the lowest income levels, that's been well documented. That's obviously been beneficial for all the enterprises that have otherwise been hurting severely," Hamrick said.

Evermore added that the "real pain" these individuals who lose the $600 a week will feel, will spread to the rest of the economy.

"These people aren't going to be able to pay their rent anymore. Their landlords won't be able to get money," he said. "They're going to spend less money on groceries. The grocery store is going to hurt."

"Everyone who is not on unemployment insurance should be just as worried about this as people who are getting a check, because if you don't think that the $600 helps you, you're wrong," Evermore said.

Some jobs may not be coming back anytime soon...if at all

Hamrick also suggested that many of the jobs lost in the pandemic aren't coming back soon, another reason why calls for extended unemployment insurance are mounting.

"We know that broadly we've recaptured only about a third of the jobs that have been lost overall, and the reality is that the longer this persists, and it will undoubtedly persist for a while to come, there is a high likelihood that more and more of these individuals will be unemployed in the longer term," he said.

A FiveThirtyEight analysis of Bureau of Labor and Statistics data found that permanent layoffs have comprised an increasing portion of workers losing their jobs since March.andrew Stettner, a senior fellow at the Century Foundation, a progressive think tank, told ABC News that yanking the extra $600 a week from those pushed out of work by the pandemic "fundamentally changes what would be going on."

"Something cataclysmic happened, but we don't want the virus to wreck families and wreck the economy," he said. "So we've kind of prevented that with this $600, but now we're taking that prevention away."

"We are putting people in the line of the real dangers of unemployment," he said. This translates into people not having enough to eat, foregoing medical expenses and more dire realities, according to Stettner.

"The exit strategy for unemployment is a job," Stettner said. "But there's just not that many jobs out there right now."

Eviction 'tsunami'

Included in the CARES Act was a 120-day moratorium on evicting tenants for nonpayment of rent from federally-backed apartments -- which includes multi-family units with mortgages held by Freddie Mac and Fannie Mae, public housing and other categories that comprised approximately 25% of the rental housing across the country, according to the Urban Institute.

The moratorium is set to expire on July 24, meaning landlords can then file new evictions then.

In addition to the federal eviction moratorium, many state and local governments have instituted their own bans, though a handful of these have either expired or are set to expire within weeks. Moreover, later this summer, the Federal Housing Finance Authority's foreclosure moratorium for federally-backed homes and properties is set to expire on Aug. 31.

Some 11 million renter households could be served with eviction papers over the next four months, according to a new analysis from the National Coalition for a Civil Right to Counsel and the advisory firm Stout Risius Ross.

Moreover, researchers at the nonprofit think tank the Aspen Institute project that between 19 million and 23 million American renters are at risk of eviction by the end of September. This is approximately one in five of the 110 million Americans who live in renter households.

"This data shows us that all the terms people have been using to describe what's coming -- 'cliff', 'tsunami', 'avalanche' and so on -- might actually be an understatement," John Pollock, the coordinator of advocacy group the National Coalition for a Civil Right to Counsel, said in a statement announcing their findings.

"The only reason we haven't already seen two million eviction filings is because of all the CARES Act relief that at this point is either going or gone," he added.

Anne Kat Alexander, the project lead of the COVID-19 Housing Policy Scorecard at Princeton's Eviction Lab, the largest database on evictions, told ABC News that they expect "millions of families to face eviction and homelessness over the next several months."

Their research also shows that evictions disproportionately hit communities of color, saying, "unsurprisingly given the history of racism in this country and systematic oppression, black renters are significantly more likely to be filed against than white renters."

The Eviction Lab has rolled out a COVID-19 Housing Policy Scorecards to help renters across the country know what protections are in place in there areas.

"For the Score Cards, we've analyzed thousands of emergency executive orders, court orders, emergency legislation, in order to distill exactly what these orders mean for tenants," Alexander said. "We identify for each state what measures are in place now, so if a tenant is looking at this they are able to determine what protections are available."

According to their methodology, Connecticut currently has the highest score with measures in place until Aug. 22. In last place is Texas -- where many protections have already expired.

"Most of the protections that are still in place at the state level will expire by this fall, there is still time for some of those to be renewed, there's also room for emergency legislation to be passed now that it's evident this crisis isn't over," Alexander said. "We're going to keep the scorecard up and running until it's really all over."

Alexander noted that they don't advocate for policies due to their nonprofit status, but said, "It's certainly clear based on what we're seeing now that a lack of protection for renters is correlated with more eviction filings."

"If more families are displaced, it will have enormous consequences for the family. Eviction filings can follow you and make it a lot harder for you to secure decent safe housing over time," she added. "It will also have enormous public health implications families without homes cannot stay at home and cannot shelter."

Hamrick also noted that there are financial consequences to eviction moratoriums, and that while many people "tend to think about landlords as perhaps being large commercial entities" there are "also plenty of landlords who may be thought of as Mom and Pop operations, they are no better set up to accommodate lack of payment and rent than the renters are set up to accommodate an end to their incomes."

"There need to be broader solutions thought about," he added. "Ultimately, what we need is a bridge until the time when safe and effective vaccines are readily available."

"It should not be more than a year, so we're really talking about building a bridge to the time when not only can we heal from the virus, but the economy can truly be on the path of healing on its own," Hamrick said.

What help is available?

Many economists have advocated for extended, revamped unemployment benefits of some kind as the unemployment rate remains elevated. Currently, it seems unlikely Congress will pass an extension before then. Republicans have argued against the benefit, saying it discourages people from going back to work.

Some proposals being tossed around include lowering the extra $600 a week to $200 or $400 in addition to states' normal unemployment insurance, tying benefit amounts to the wage workers were making before becoming unemployed or structuring benefits to automatically decrease when certain economic recovery milestones are met.

Even if Congress were to pass something imminently to extend unemployment benefits, people likely won't see that extra cash for a while, Stettner warned.

If it is extended, "I've been telling workers best-case scenario, they could be able to start getting the $600 again by the end of August," he added.

Lawmakers need to pass relief bills that include "things like extended unemployment insurance, food stamps, things that keep individuals solvent and keep individuals from having an economic crisis escalate into a health crisis," Hamrick argued, adding that the unemployment aspect is "critically important."

"That sense of urgency has seemingly been absent here more recently," he added. "Admittedly members of Congress are accustomed to allowing lapses in attending to legislation that they need to pass, and we've seen that in the past when we've had government shutdowns, but this issue does need to be resolved."

Hamrick also said that it is never too late to take control of your financial goals, saying, "the unfortunate thing is that during this remarkable and unprecedented time, it really shines a light on the fact that many Americans did not have emergency savings."

Alexander, at the Eviction Lab, added that many states and local governments have instituted new emergency rent support programs.

"I would advise [renters] to look into whether emergency rent aid is available because, a lot of places have programs now that didn't before and a lot of them are being funded at levels that we haven't seen," she said.

"I'd also encourage tenants to reach out to legal aid organizations in their communities to seek further advice and explanation about their rights during this crisis," she said.

"We've seen reporting that landlords are still posting notices even though they can't actually evict tenants," she said. "It's good to remember that if you are in a place where there is a no enforcement order, where there is an eviction moratorium, your landlord can't change your locks, your landlord can't shut off your power, those actions are illegal."

"There are a lot of self-help resources available online in terms of explaining rights," she added, though recommends, "it's best to really go consult a legal aid attorney to really make sure that you're aware of all your rights."

Finally, Stettner said that even many of the critics who argued the bolstered unemployment disincentivizes people from getting jobs, "have gone away from that idea, because of how hard it is to find jobs."

"I think people that are going back to work or working, period, should be getting extra money right now because a lot of them are at risk," he said. "But I don't think that's a replacement for unemployment benefits, that's something you should put on top of it."

ABC News' Sarah Kolinovsky, Victor Ordonez and Layne Winn contributed to this report.

This report was featured in the Friday, July 24, 2020, episode of “Start Here,” ABC News’ daily news podcast.

"Start Here" offers a straightforward look at the day's top stories in 20 minutes. Listen for free every weekday on Apple Podcasts, Google Podcasts, Spotify, the ABC News app or wherever you get your podcasts.

Editor's note: The story has been updated to clarify that the data from the Aspen Institute measures individuals, not households.