Supply, demand and 'geopolitical tensions': How oil prices rise

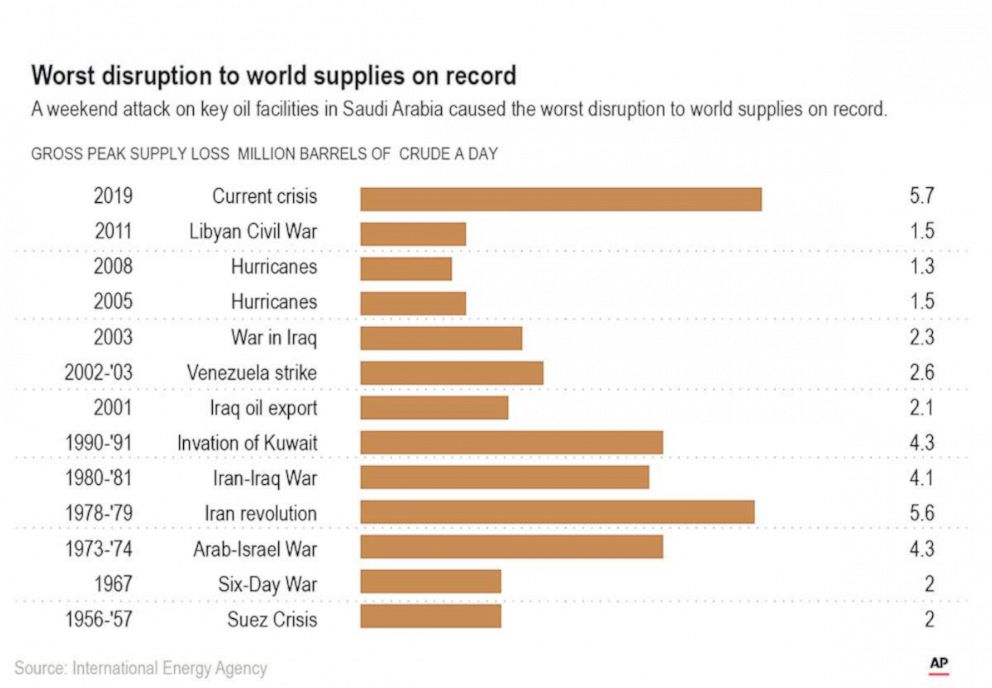

Global oil prices spiked Monday by a whopping 20% seemingly overnight after an attack on a major oil facility in Saudi Arabia.

With global consumption at 100 million barrels of oil a day, the sudden rise in oil prices had a ripple effect on international markets, which took a tumble Monday. ABC News spoke to an oil industry expert to break down what exactly causes the prices for this global commodity to rise and fall.

'Supply and demand and anything on either side of that'

As for what causes oil prices to rise? "It's all kind of a balancing act," Patrick DeHaan, the head of petroleum analysis at fuel price website GasBuddy told ABC News.

"Oil prices are very sensitive," DeHaan said, adding that at a basic level, they are driven by "supply and demand and anything on either side of that."

"Anything that touches on those two things, which is a myriad of issues, this time around on the supply side, it's Saudi Arabia that's having an impact," he added.

"In this case it's pretty shocking that Saudi Arabia suffered this missile attack on its oil infrastructure," DeHaan said. "We are now looking at a sudden unexpected drop in oil production to the tune of millions of barrels."

On the opposite side of that, DeHaan said a "good example of oil prices plunging was when Saudi Arabia signaled in 2014 that they were going to raise oil production."

"An increase in production can cause oil prices to plummet just like an unexpected outage would cause oil prices to soar," he added.

'Geopolitical tensions disrupt the flow of oil'

While factors like supply and demand generally drive the price of oil, "these oil traders are like you and I," DeHaan said, saying that markets can be unpredictable at times.

"There are some expectations that the market does have … the biggest expectation is the one that the Saudis gave us which is that they will be able to restore this production within a matter of days, not weeks," he said. "If that expectation is not met then oil prices will react more vigorously."

Another factor to consider is if there is another attack or a military response "that could also cause oil prices to go up just because of the risk that such action would further disrupt the normal flow of crude oil," according to DeHaan.

"These geopolitical tensions disrupt the flow of oil, whether that oil is flowing to the U.S., oil is a global commodity, so what happens in the U.S. or what happens in the middle of nowhere in the Middle East is going to tilt prices higher or lower for everyone," he said.

"The tentacles of oil reach far beyond the country where action or inaction take place," DeHaan said. "That level of interconnected-ness means that problems no matter where they are affect anyone who consumes oil."

Another factor that can affect the price of oil in "times of crisis" or "major disruption" is the Strategic Petroleum Reserve, which President Donald Trump tweeted Sunday evening that he authorized the release of in an amount "sufficient to keep the markets well-supplied" in the wake of the news out of Saudi Arabia.

The SPR simply "acts to limit the concern of oil trade being severely disrupted," according to DeHaan.

While DeHaan predicts we're "not to the point of needing that oil just yet," as the Saudis have said they have inventories to utilize to make up for any drop in output, the SPR "would help limit the impact of oil prices and thus gas prices."

Another factor that can bear influence on oil prices is the Organization of the Petroleum Exporting Countries (OPEC) which has control of about one-third of the world's oil production, according to DeHaan, who said, "they control a significant amount of oil production."

What does this all mean for consumers?

For consumers, "The impact at the pump is kind of directly proportional to the level of shock that any news would bring."

As for short-term effects for consumers from Monday's spike in oil prices, DeHaan says consumers shouldn't be too wary yet.

We may see "gas prices going up a few cents per day for the next few weeks," he predicted. "I'd say the total impact is going up 10 to 25 cents a gallon two weeks from now."

"But I don't think that gas prices will rise above their previous 2019 highs," he added.