Radio host Dave Ramsey on battling his own debt crisis and lessons about money from the Bible

In the pantheon of financial gurus, Dave Ramsey holds a unique position.

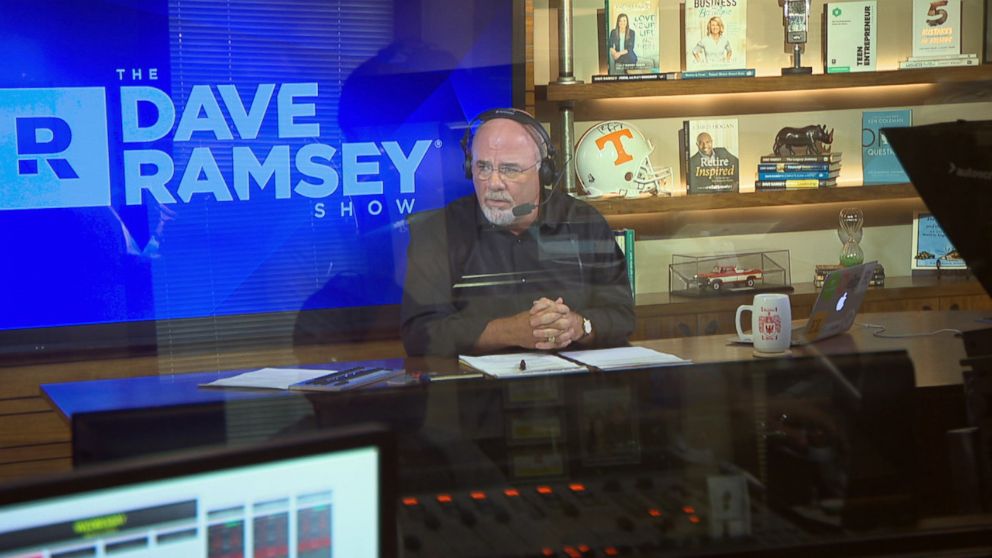

Known for his pull-no-punches, sock-you-in-the-mouth take on finances, Ramsey is one of the most listened-to talk radio hosts in America with 13 million listeners weekly -- trailing only Rush Limbaugh and Sean Hannity.

He doles out his brand of financial discipline to people desperately in need over 600 radio stations across the country. His daily dose of tough love has also racked up more than 100 million views on his YouTube channel.

“Debt's not the problem, it's the symptom,” the host from Antioch, Tennessee, told “Nightline.” “Debt is the result of being disorganized, immature, buying things I can't afford to impress people I don't really like.”

In a year that has seen historic levels of household debt in the country -- the average American has nearly $30,000 in student loan debt according to the Federal Reserve Bank of New York Consumer Credit Panel and over $6,000 in credit card debt according to Experian's State of Credit study -- Ramsey is an anti-debt crusader who uses his platform to help Americans become debt-free by any means necessary.

He said that currently, the American economy has no overarching theme.

“There are pockets that are doing worse. There are pockets that are having the best years of their lives. There's pockets that are taking control of their own destiny for the first time ever,” he said.

There’s a lot of good happening, Ramsey said, but, he said, “All of us, particularly those of us in the media, we’re experiencing and watching and walking in this toxicity that’s out there, too.”

“There's this tremendous hatred and visceral stuff that's going on that's not causing people to win and it's affecting their money,” he continued. “That sounds very philosophical, not economic, but it affects the economics.”

In today’s polarizing political and cultural climate, Ramsey isn’t known for coddling his listeners.

“If you call me up and say, ‘Well, I need to do this dumb thing, I need to do this dumb thing,’ I'm like, ‘No, do this instead, not do this dumb thing,’” he said. “I'm going to increase the heat, but it's not for the entertainment value, it's for the good of that person. Because if I don't get through to them, they're going to do that dumb thing. It's going to hurt them.”

Sometimes, he makes an exception.

“I had a lady call me yesterday, her husband had just passed away. I'm certainly not drill instructor with her. I'm going to be right there with her and walk with this lady. Her heart's broken. I just say, ‘Hey, here's what we're going to do with money for a little while. Nothing. You need to just cry a little. It's okay,’” he said.

But when it comes to doling out his thoughts on the government’s finances, he doesn’t hold back.

Ramsey, an Evangelical Christian, said he supports some of Trump’s policies.

“I support his policies, some of them. But as a person of faith, I can't support his behaviors or sometimes his attitudes,” he said. “The tax law that passed, if you can just back away from all the Trump part of it and just say, ‘Look at what has occurred,’ as a small business person, I'm able to hire a lot more people. I'm able to do a lot more things to help people, because I'm not being taxed as heavy.”

He added that he doesn’t spend time on “merging those two worlds.”

“I don't care who you are. I don't care what your religion is, I don't care what your politics are, I don't care what your orientation is, I don't care what your race is. I'm going to help you. That's who I'm for,” he said.

Battling his own debt crisis

One of the first people that Ramsey helped was himself.

Forced to declare bankruptcy after losing most of their money in real estate, Ramsey and his wife hit rock bottom in the 1980s.

“I was stupid. I borrowed money out my ears, man, and out my eyeballs and everything else. We were so far in debt we couldn't breathe. Ruined our lives and it made our lives,” he said.

But Ramsey battled back. And after lecturing about financial responsibility at his local church, he tried his hand at giving financial advice at a local radio station.

His style wasn’t rooted in complicated financial equations or investment strategies but simple, easy to understand principles applied with ruthless execution.

“You go through something like that you have some ‘no matter what’ moments where you say, ‘I used to do that, but no matter what, I'm never doing that again, it hurts. No matter what, I'm putting myself or my family in this position again,’” he said.

He added, “Every time I come up to the edge of borrowing money, or lowering our level of generosity, or not living on a plan… Those are all ‘no matter what’s’ for us. Some people talk about it like it's a negotiable principle or something. When you've been through what we've been through, it's not negotiable anymore.”

His best-selling book, “The Total Money Makeover,” breaks down his philosophy into easy-to-learn “Baby Steps,” as he calls them.

For instance, “Baby Step 1” is save $1,000 cash for emergencies while “Baby Step 4” is to invest 15 percent of your income in retirement.

When asked about merging his faith with finance, Ramsey explained, “The Bible talks about money a lot. Even if you're not a Christian, what the Bible says about money is mostly common sense. It's live on less than you make, save money."

An expanding family business

Ramsey’s anti-debt empire, in suburban Nashville, is expanding. Scattered over five buildings, he has a staff of 750 people, which he said he hopes to increase to around 800 by the end of the year.

Business, he said, was “very good.”

The walls at his headquarters are full of photos of him with a diverse group of, what he calls, “Ramsey personalities.”

“They're the brands out front. So Anthony's [O'Neal] in the youth and millennial space. Christy [Wright] has a number one bestseller called ‘Business Boutique: Equipping Women to Make Money Doing What They Love.’ She's in the women in leadership and business space. [Ken] Coleman has a show on XM on careers, a brilliant young guy,” he explained.

The heir apparent to his vast empire is none other than his daughter, Rachel Cruze.

“It is a family business,” Cruze told “Nightline.” “Thankfully we’re all loving it. And really called to each of our positions. So I get to travel and speak and do my YouTube show all while helping people with money. So carrying on the legacy of dad’s message but in my own way.”

She described her style as “I’m your friend, I will walk beside you,” as compared to her father who she said was “more like everyone’s fun loving uncle, but will hit you with the truth if you need the truth.”

While the walls of his office are littered with success stories, some in the financial spheres have criticized Ramsey for setting unrealistic expectations for investing and debt repayment.

“I am one of those guys, if you asked my critics, that I ripped off a bunch of poor people [by] selling them books. Those poor people who got out of debt don't think I ripped them off. We aren't ashamed of succeeding by helping,” he said.

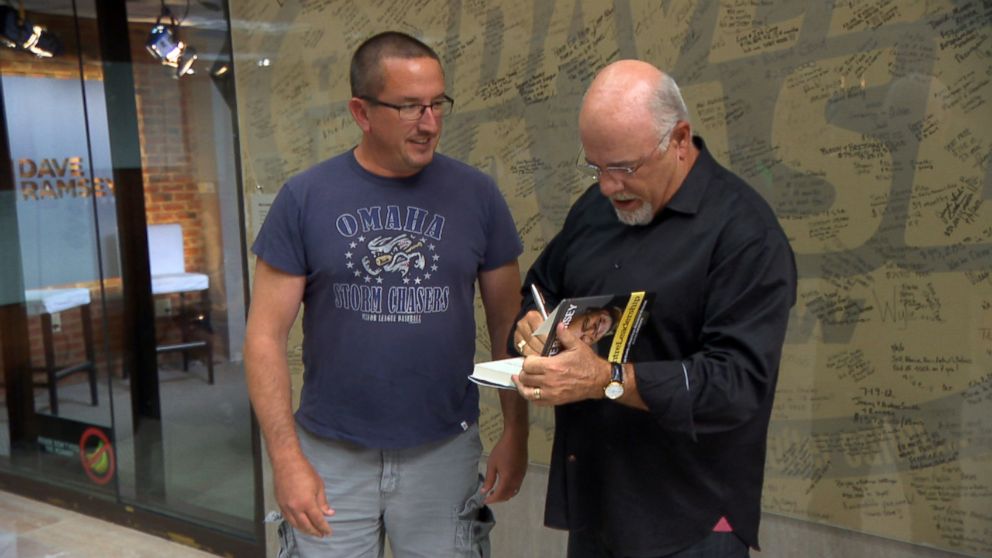

His message of helping people clicked with Julia Huellemeier and her husband, Robbie Huellemeier.

After graduating college and graduate school and then buying their first house, the couple found themselves swimming in debt of over $250,000.

Then, Julia Huellemeier stumbled across a book with Dave Ramsey’s face on it.

“We actually found it at a yard sale for a dollar so we picked it up and read it very quickly. Then we paid off all of the student loan and the car within the first couple of years,” Julia Huellemeier told “Nightline.”

The couple managed to pay off their home mortgage within five years – a feat they credit Ramsey with.

“That was probably the best dollar I've ever spent,” she said.

The couple recently went to Ramsey’s headquarters to participate in “A Debt-Free Scream,” a tradition involving newly debt-free people from across the country to visit the office and shout their joy at their financial guru.

“One of the things we put on the wall around here, if you help enough people, you don't have to worry about money,” said Ramsey. “So, the secret to our success is that we've helped a bunch of people.”