A marriage of 2 technologies: Inside the Toyota, Uber self-driving car deal

Where Toyota sees a minivan, Uber sees a driverless taxi. Now both companies are getting their vision.

Toyota is investing $500 million in Uber, the companies announced Monday, moving the embattled ride-sharing company toward a self-driving future with a partner. The two companies will continue to develop their own driverless technologies to work in sync with a pilot fleet of cars modeled on Toyota’s Sienna minivans.

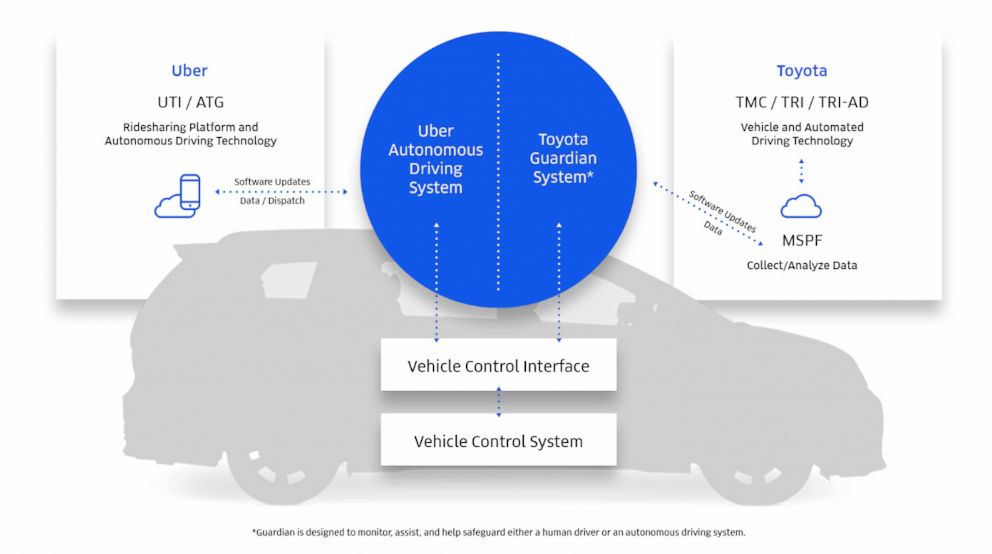

“You have two systems that are both active,” Jeff Miller, Uber’s head of automotive alliances, told ABC News. “On today’s cars, you have some advanced braking functions. So, in the event you’re approaching a car and the car knows you’re about to hit it, it will actually engage the brakes before you, the driver, does. It’s a backup safety system. That’s what Toyota’s state of the art, advanced, autonomous safety system does."

“So that will be running passively behind the scenes while our system will be running actively,” Miller added. “Our system will be making the active decision on where the vehicle goes at all times, where it’s turning, the speed, how much brake, how much torque to apply to the wheel, and [it] is the primary autonomy system on the vehicle.”

The two separate systems will approach an agreement in the event a conflict occurs. “We still have plenty of work to do together to identify exactly how the two systems coordinate the decision-making if and when there’s a disagreement on what the situation presents,” Miller said. “All of the scenarios are worked out. The default in the autonomy world is when in doubt, the vehicle will come to a safe stop. That’s what’s hard-programmed in.”

The eventual self-driving fleet, which will be owned and operated by a third party, and ready to deploy in 2021, will start with a small pilot program of a few hundred vehicles, the company said.

The partnership signals the end of Uber’s quest into the driverless car market on its own. It could also indicate an earnest attempt to continue to be regarded and regulated as a technology platform, instead of a transportation company. Uber CEO Dara Khosrowshahi stressed the platform in his statement announcing the move. “Our goal is to deploy the world’s safest self-driving cars on the Uber network, and this agreement is another significant step toward making that a reality."

“It’s a piece of a much bigger puzzle," said Larry Downes, project director at the Georgetown Center for Business and Public Policy. "Each of those companies has interesting reasons to get involved with the other. The car companies have awoken to the fact that there’s really a big set of transformational tech coming. The autonomous vehicles are going to happen. No one knows what that means for cars [or] insurance. Everyone is placing bets and hedging them.”

Toyota's safety record and customer service makes the Japanese automaker an attractive partner for Uber. For Toyota, the deal allows it to get into the autonomous car market without bearing all of the risk of developing cars, which can be hard to track and keep properly maintained after they are sold to an individual, industry experts say.

“This is one of the best outcomes they could have for the automated driving program,” Navigant analyst Sam Abuelsamid said about Uber. “From what we’ve seen, they were certainly taking a lot of shortcuts. We saw more accidents on the road with their vehicles, like running red lights and collisions with other vehicles, before that accident in March in Arizona.”

In March, an Uber Volvo SC90 struck and killed 49-year-old Elaine Herzberg in the nation's first fatal crash involving a pedestrian and a self-driving vehicle. The company temporarily shut down its self-driving program in Tempe, Arizona before restarting in Pittsburgh.

Uber denies that the Toyota partnership is a reaction to the accident in Tempe, noting the Japanese auto giant's 2016 investment in its core business, Toyota discounts for Uber drivers, and creative leasing structures for drivers in India.

"This is not something that was initiated after Tempe, it was something that has been going on, was in the works," Miller said. "We had to have our short term focus fully on how we respond to Tempe, what can we learn from it, how can we improve as an organization, but not let this short-term focus distract from what two big global giants wanted to do together long-term. At the executive levels, where we were talking about this deal, we were keeping a long-term view to how this technology was going to be deployed over decades, not months."