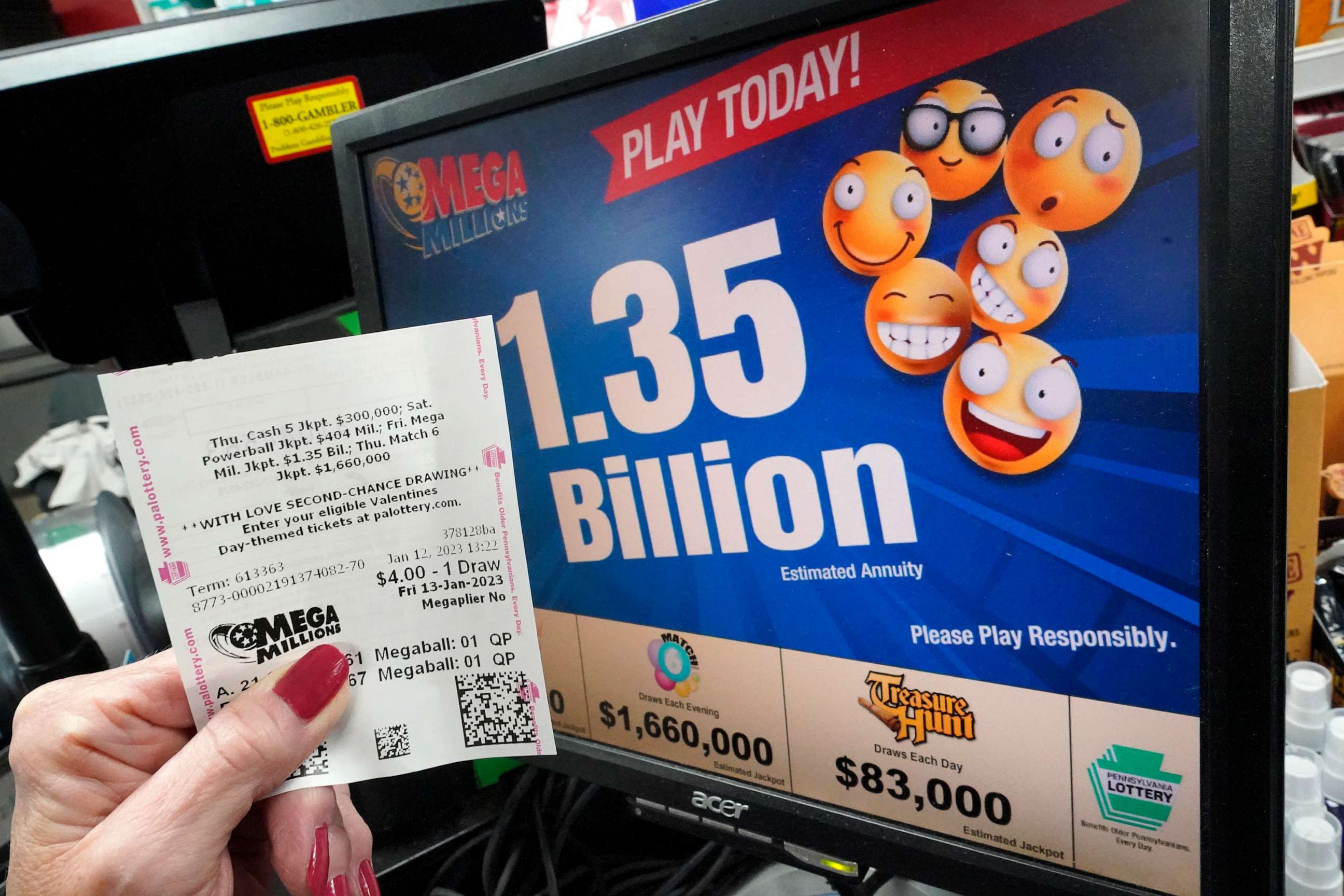

So you won the Mega Millions jackpot. What happens now?

The Mega Millions jackpot has risen to $1.35 billion dollars. With Americans across the country rushing to secure tickets for the chance to win big, it's likely someone will hear their ticket numbers announced Friday night.

But, for those lucky winners who become millionaires overnight, what comes next?

While buying a mansion, going on a dream vacation or taking an extended shopping spree may seem like the most logical first move after winning the lottery, there are actually a few steps someone has to take to claim and obtain their prize.

Keep it quiet

The first step experts suggest for winners is harder than you may think -- keep your mouth shut.

Experts say that keeping as little people in the know about your big win is key.

Walt Blenner, an attorney who's worked extensively with lottery winners, said the more relatives and friends you tell, the more likely the news will get out.

Especially for big wins, like a Mega Millions jackpot, safety is priority, Blenner said. He suggests that winners get out of town, just far enough to be under the radar.

"You don't need to rent a dacha in Siberia -- my last big winner rented a modest house under an assumed name just a few dozen miles away from where he lived for one month," Blenner told ABC News. "Putting distance between the lottery winner and familiar surroundings is best."

Kurt Panouses, a seasoned "lottery lawyer" from Florida, told ABC News that many of his big-winner clients are grateful they kept their winnings private, so they could live their lives without safety concerns or awkward questions from friends and family who could view the winner as a money source.

Get professional advice

After ensuring your safety, experts say it's imperative to get advice from qualified and experienced professionals.

While not all professionals use the same strategies, finding one that suits you can ensure that you make the best decision after scoring a winning ticket.

"You're talking about the most important financial decision that they and their family is ever going to make," said Panouses, who is also a certified public accountant.

Blenner believes in bringing in a team of professionals for specific needs. He said his primary job is to line a winner up with a financial team, including a wealth manager, tax attorney and a CPA. He also helps the client redeem their ticket, which is a process in itself.

Ultimately, finding professional guidance is key for a lottery winner as they navigate the many steps to becoming a millionaire.

Using trusts and LLCs

It's common for lottery winners to set up a trust or a limited liability company, LLC, to claim their winnings from.

For some states, this means that you can claim your prize without using your real name, instead using the name of your LLC.

Depending on a state's rules, you may have to jump through hoops to keep your identity safe.

Panouses said that when helping winners in Michigan, he had to create a club to claim the winning prize. Panouses came as a representative of that club to claim the winnings for his clients that had joined this "club" and their identities remained safe.

Trusts and LLCs can be used for one or more people, Panouses said, and ultimately make a safer process in claiming your prize.

Seeking professional assistance allows you to therefore establish a trust or LLC to use in this process.

Decide if you want to share

While winners are encouraged to stay quiet about their jackpot, experts say it's better to decide before you claim if you are going to share your prize.

This is because any sums given after someone claims their prize will have a certain gift tax on it, which will end up costing the winner more money.

Experts say to figure out who you would be sharing the winnings with, and establish the percentages of who gets what. Everyone who is going to be claiming a piece of the prize can be joined together in a trust or LLC that is used to claim the money.

This way, no additional taxes will be added if you were planning on sharing the money.

Sharing the claim like this, experts say, also allows the main winner to save on the initial taxes, as everyone involved in the claim will take on parts of the income tax.

Cash or annuity?

Another decision lottery winners will be faced with is the decision to accept the cash lump sum or to take the winnings through annuity.

A cash lump sum means accepting the entire payment all at once, while annuity means accepting a series of payments over time.

It's more common for winners to take the lump sum, Blenner said, because it provides them with the freedom to invest as they wish with maximum available funds up front.

Annuity may be a simpler option for those not familiar with organizing wealth, as a lump sum leaves you with a large, immediate sum that can be very overwhelming, Blenner said.

Panouses said the decision depends on who you are, where you are and what you are going to do with the money.

For young people, or someone more inexperienced with finances, annuity is a much safer route, Panouses said.

However, due to the high rates of inflation right now, annuity may be a better option for others, too, because of the impact on taxes. Essentially, the initial taxes taken out of a lump sum payment will be greater right now due to inflation.

Taking annuity means that some of your future earnings may not be so heavily taxed and you'll keep more of the original prize.

But, if you live in a high-tax state or city, you could then risk losing more each year on taxes as you receive the new income.

If you will be taking on the full prize by yourself, your experience with finances and your projected tax costs are essential starting points to deciding if a lump sum or annuity payment is right for you.