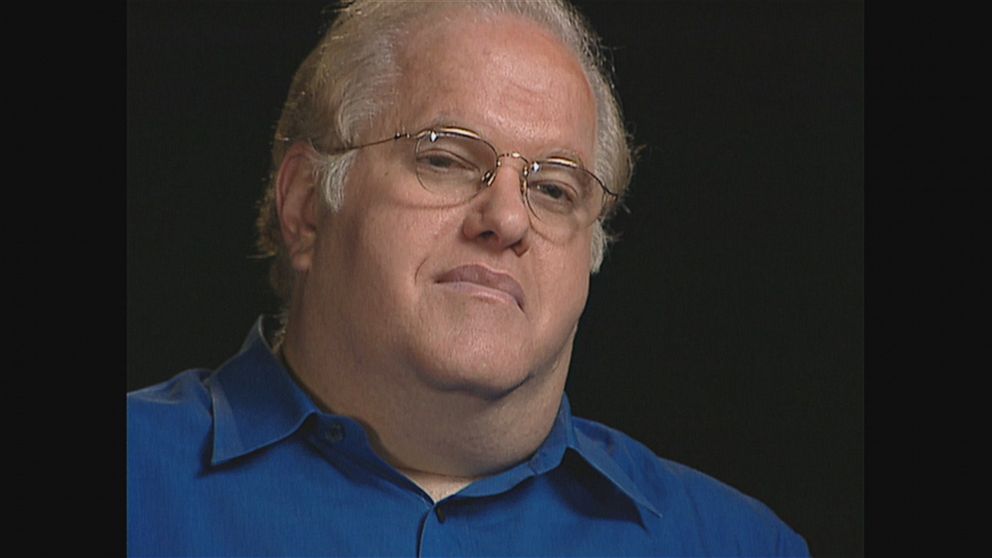

How Lou Pearlman used Backstreet Boys, *NSYNC to lure people into massive Ponzi scheme

Even after Lou Pearlman’s con was uncovered – and as he sat in a prison cell serving a 25-year sentence – the notorious manager of *NSYNC and Backstreet Boys wasn’t ready to give up his moneymaking ways. He started a choir behind bars and then tried launching a reality television show.

For decades, the businessman impressed investors with limo rides, flights on private jets, and paraded them by the studio where the huge stars he’d groomed were rehearsing.

All that flash, and the promise of a significant annual return, presented an image too enticing for investors to resist. But, no one knew that the performers raking in millions were barely making a living wage – and his investors did not realize the millions they gave him would be gone forever.

But some say if it weren’t for Pearlman’s unchecked greed, these bands that helped to define pop culture in the 1990s and early 2000s would never have taken off.

Pearlman gets into blimp biz, then find boy bands

Pearlman got his start in the blimp business in the early 1980s. Later, he started chartering airplane flights, which he says led him to meet New Kids on the Block.

“I just didn't know who they were and I was just questioning, ‘How could these kids afford an airplane?’” Pearlman told ABC News in a 2000 interview. “I was told these kids did $200 million in record sales and $800 million in touring and merchandising. I was like, ‘I'm in the wrong business.’”

He was determined to create his own group to rival New Kids on the Block’s success. In 1991, Pearlman moved all his businesses to Orlando, Florida, a city that had become a hub for young talent who flocked there for roles at the theme parks.

Before long, he had the makings of Backstreet Boys. Nick Carter, AJ McLean and Howie Dorough auditioned. Kevin Richardson was discovered at Disney World where he was playing Aladdin. He recommended his cousin Brian Littrell in Kentucky.

“I put the money out to help them,” Pearlman said. “We'd give them choreographers. We'd give them vocal lessons. We’d give them tutors. … I think I'm a great cultivator.”

In 1997, the group made it big in America with the release of “Quit Playing Games (With My Heart).” The song sold 2 million copies in the U.S. and became the most successful single on the Billboard Hot 100 chart that year.

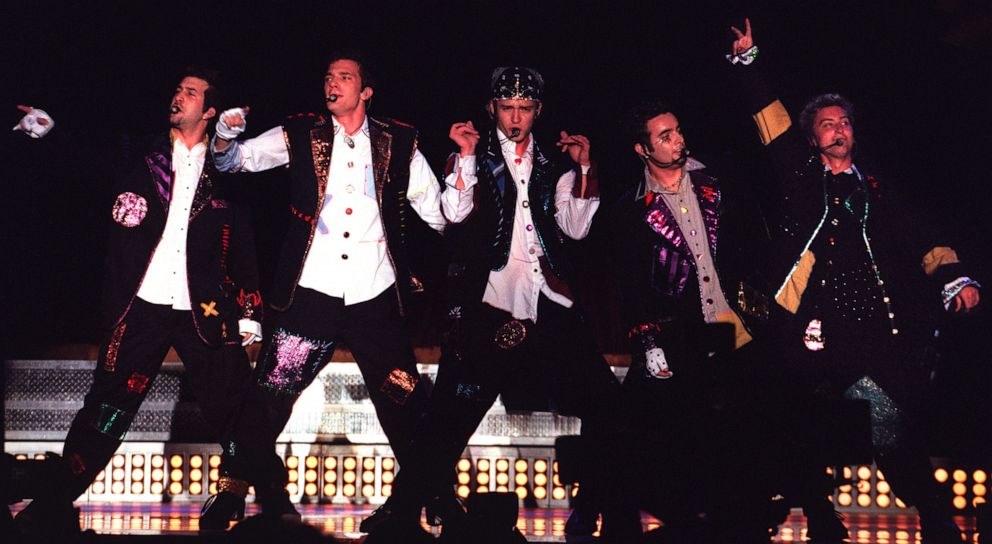

While the band rose to fame, Pearlman used many of the same methods to develop *NSYNC. Justin Timberlake, Chris Kirkpatrick, JC Chasez, Joey Fatone and Lance Bass made up the group -- launching a legendary rivalry between the two bands.

However, as Lance Bass told ABC News, while *NSYNC was achieving massive success, he and his band mates were provided just $35 a day, and that was for their per diem.

Still, Pearlman wasn’t finished. He started LFO, whose 1999 single “Summer Girls” peaked at No. 3 on the Billboard charts. He also created C-Note and Take Five. He wanted to get involved in girl groups as well, and created Innosense, a group that Britney Spears briefly joined before going solo. Additionally, Pearlman managed Aaron Carter, Nick Carter’s younger brother.

TransCon investors lured in by bands’ success

Pearlman used the high profile success of his boy bands to lure investors, many of them retirees, to put their hard earned money into his other businesses, which he said were all housed within his corporation named TransContinental.

He claimed his TransContinental empire included an airline, a film and music studio, talent and travel agencies as well as restaurants and real estate. He even formed a record company under the umbrella during *NSYNC’s rise.

Pearlman launched an investment scheme for investors he called an “employee investment savings account.” Forensic accountant Jerry McHale told ABC News,“He also set up a network of sales people to sell these products.”

Pearlman promised investors it was a safe and secure investment, and offered substantial returns year after year. He also claimed the plan was FDIC insured and backed by insurance companies AIG and Lloyd’s of London.

Retired FBI Agent Scott Skinner told “20/20,” “Anytime we see the representation coming from one of Lou's companies that the FDIC, or AIG or Lloyd's of London was insuring it, we knew right then it was a fraud.”

“He would send [a] private jet to pick you up. Then when you landed in Orlando, he would send his private limo to get you,” Former Backstreet Boys manager Johnny Wright told “20/20.” “You drive to his office, which was quite impressive. Then when you walk through the door, he's on the phone with Barry Gordy or whoever. ‘Oh yeah, we'll close that deal. Don't worry about it.’”

“One of the first things they do is, ‘Welcome to TransCon. Here's our card. Here's all the companies we own,’ and you're looking at this card that folds, a business card that folds with like 40, 50 companies that he owns,” said Jacob Underwood, a member of another band Pearlman created, O-Town. “Right away, you're like, ‘Whoa, I mean, I am in with somebody really important, and this is a big deal. If he owns all these things, then he must really understand business and get it.’”

Wright said Pearlman would take investors to the studio, where they’d find the Backstreet Boys or *NSYNC recording or rehearsing.

“So you get to see it firsthand. … It's the greatest picture in the world,” Wright said of Pearlman. “It's all real to some extent because Backstreet Boys and *NSYNC are successful. They're there right in front of you.”

Wright said at one point, he spoke to one of Pearlman’s assistants when he considered investing.

“He said, ‘Johnny, I'm a loyal person to Lou but I also like you… if you ask me the right question, I won't lie to you.’ And I said to him, ‘I don't need to hear anything else. I'm not giving you my money,’” Wright said. “I walked out of his office. I never invested in that.”

Meanwhile, according to Roger Handberg, a federal prosecutor in central Florida, Pearlman had been taking out enormous bank loans – some 30 of them totaling $190 million.

“And what he would do is he would use the money to plug whatever hole that he needed to plug. So if he had bank fraud money that he needed to use to pay off an investor, he would do that. If he had a problem where he had to pay a bank some money, he would use the investor money. All the money was co-mingled-- and it was used however it would benefit him,” Handberg told "20/20."

But Jean Madigan, an investor in TransContinental, remembers what happened when she tried to withdraw money from her account with Pearlman.

“There was an office number. … Lou himself answered. … He said, ‘Hi Jean, I just want to tell you that everything's going great.’ I’m like ‘What is going on?’… I said, ‘I want to get some money out of my account. I want my money.’ He goes, ‘Well how much do you need dear?’ First I said, ‘The whole thing,’ but he says, ‘Oh, well I can't give that to you right now.’”

Madigan said she called her salesman.

“[The salesman said] ‘Something is happening. … I can’t talk about it now,’” she said, adding he never got back to her.

“I think they started shredding all the documents,” she said.

Exposing the ‘TransCon’ con

Handberg says he learned of Pearlman’s investment and bank fraud scheme in 2006.

“About eight days after I opened up our investigation, Lou Pearlman fled the country,” Handberg said. “There are some times defendants do something that show that they know that they're guilty. One of those things is fleeing… At that point, he had my total and complete attention.”

Handberg said when authorities arrived at Pearlman’s mansion in Windermere, Florida, “it looked like someone had left – in a hurry.”

“There were suspicions that there were diamonds that he hid in the walls of his house,” said Soneet Kapila, a court-appointed bankruptcy trustee. “We actually hired a company who specializes in X-raying walls to see if you have something hidden there other than insulation. … We were not able to find anything because we really went with a toothpick through the entire house and even the FBI did not find anything aside of what we did.”

Investigators also combed through Pearlman’s TransCon offices and found that his so-called TransContinental Airlines had no airplanes, employees or revenue.

“We never ever flew on a TransContinental airplane,” Lance Bass of *NSYNC told “20/20.” “We would fly to different places over in Europe, and we’d always be on these Delta flights, you know, in coach. And I always thought it was weird that someone that was in the airline industry couldn’t help us out a little bit getting to places.”

Investigators also uncovered a fake accounting firm called Cohen and Siegel, which was created to make TransCon Airlines seem like a legitimate business. Pearlman had sent investors sham financial statements from the fraudulent company to make investors believe that their investments were making money --- a classic hallmark of a Ponzi scheme.

“With Cohen and Siegel, time and time again we were finding that there wasn't any kernel of truth to anything whatsoever,” Handberg said. “It actually got to be easier for us to think and just assume everything is fraudulent.”

“It was hard not to think about Pearlman and what he had done in comparison to [Bernie] Madoff,” Handberg said, referring to the disgraced financier who was convicted in 2009 after organizing a multibillion-dollar Ponzi scheme. “They both [committed] terrible crimes that have victimized countless numbers of individuals.”

Investigators close in on Pearlman

In March 2007, Pearlman’s whereabouts were still unknown. A tourist in Bali, Indonesia, recognized Pearlman and realized that he was staying nearby, authorities said.

The tip was forwarded to the FBI, which sent agents to the island to question him. Pearlman eventually agreed to accompany the FBI to Guam, where he was arrested and taken back in Orlando in July 2007.

“For over 20 years he'd gotten away with it,” Handberg said. “It had all worked. I mean, he had told some of the biggest lies that you can tell. He had made things up. He had made up an accounting firm. He'd made up a bank. And no one had ever caught him.”

“So from his perspective, ‘Well, why now? Can't I just talk my way out of it?’ But he couldn't talk his way out of it with me and the agents because we had the evidence,” he said. “We knew about the lies and we knew about the deception.”

Fletcher Peacock, the federal public defender who represented Pearlman, spoke to “20/20” about the case.

“One of the things we often say in my business is, I wish I was his lawyer before I was appointed. I think Lou needed somebody to tell him, ‘No,’” Peacock said. “I fully believe this guy could have been one of the most talented people in the entertainment industry and was on his way to being so. It just wasn't meant to be.”

Pearlman pleaded guilty to conspiracy to commit bank fraud, money laundering, bankruptcy and fraud in 2008. Handberg said he “could have emptied the federal criminal code” when charging Pearlman.

“We looked at the harm he caused,” he said. “He was ordered to also pay $310 million in restitution and to pay a $200 million forfeiture judgment.”

Seth Abramovitch from “The Hollywood Reporter” spoke with Pearlman in 2013, after he’d spent five years in prison.

“I wanted to hear what he thought about comparisons to Bernie Madoff. He felt Bernie was a true criminal whereas he was not because he had the boy band thing going,” Abramovitch told “20/20.” “[Pearlman] sort of put [Madoff] at arm's length and said, ‘Well, that's a real criminal. I'm a legitimate guy, and things just kind of got out of my control, and so I'm not a real criminal.’”

A judge offered Pearlman an unusual proposal in an effort to uncover any funds that Pearlman might have hidden: For every million returned to victims, Pearlman would get a month shaved off his prison sentence.

“I think Mr. Pearlman might've misinterpreted what the judge was really getting at,” Handberg said. “Mr. Pearlman's thoughts immediately went to, ‘Oh, I wanna have a reality show in jail.’”

Pearlman turned to what he knew best and started a Christmas choir inside prison – he even held auditions.

Emily Dorsett, a talent developer, wanted to help his venture behind bars and flew from California to Florida to meet him.

“He was very upbeat. He wanted to recreate “Making the Band,” which was his hit TV show back in the early 2000s with O-Town,” Dorsett told ABC News. “He wanted me to help him try to get that going, and I told him I would.”

Though Dorsett and Pearlman would stay in touch, the former music mogul never created a new television show from prison. And while some money was recovered from the many millions that Lou Pearlman took, it was a small fraction of what investors had lost – in some cases, their life savings.

“Something that I think gets overlooked [is] that Backstreet Boys probably wouldn't be the Backstreet Boys if he hadn't stolen all this money from the Ponzi scheme,” Abramovitch said. “He kept putting more and more millions into it until they finally did catch on with a hit single.”

Pearlman never realized his dream of making one more boy band. He died in prison in 2016 of heart failure at 62.

“When I heard that Lou Pearlman had passed away, I was so confused on exactly how to feel because you did have every emotion for this guy,” Bass said. “You loved him. You hated him. And it pissed me off that he passed away.”

“There's so many life lessons that you learn from everyone else's mistakes, from your mistakes,” Bass added. “He helped start my career. He funded it… I don't know where I'd be without him. So you have to give him that credit.”