Florida Woman Claims Diet Pills Led to Home Purchase She Regrets

— -- There's buyer's remorse, and then there's buyer's remorse by reason of temporary lapse of judgment due to diet pills.

At least that's the claim of a Florida woman who is asking a court to let her back out of a home purchase because, she says, "judgment-altering" diet pills led to a decision she now regrets.

Mary McKaig of Orlando, Florida, said she mistakenly bid on a foreclosed home that has more than $400,000 of debt, according to the Orlando Sentinel, citing court papers. McKaig, 54, bid for the home on the website RealAuction.com on Feb. 19, the same day she began taking her prescription of phentermine diet pills, according to her court filing.

On Feb. 23, she filed an objection in Orange County circuit court to halt the sale, which is permitted within 10 days of a foreclosure auction, according to Florida law. In documents provided by RealAuction.com, the four-bedroom home in Windermere, Florida, has an assessed value of about $276,878. McKaig claimed in her court papers that she immediately realized she made a mistake after submitting the bid of $100,500, according to the court filing.

McKaig filed her objection to the sale in a lawsuit case filed by the homeowners' association against the original homeowner over the foreclosed property's $15,929 in overdue fines and fees. In response to McKaig's filing, the homeowner's association, which wants the sale to close so it can be paid, said "lack of knowledge, however, or lack of due diligence is not a mistake," according to the association's filing with the court on Feb. 26.

"Phentermine is an appetite suppressant," the homeowner's association states in its response and in its court exhibit. "'Altering judgment' is not listed as an adverse reaction or a side effect to taking Phentermine under the Physicians' Desk Reference and Web MD." The homeowner association's court exhibit points to potential adverse reactions, including nausea, irritability, dizziness, psychosis, dry mouth and change in sexual desire.

The Phentermine.com website lists “less common or rare symptoms,” including clumsiness, confusion and tiredness.

McKaig was "solely responsible for research regarding [the house]" but "had not discovered the mortgage before the sale," her attorney wrote in the court filing.

Lloyd McClendon, CEO of RealAuction.com told ABC News that the sale was conducted properly without any errors. McKaig placed $120,000 in her deposit escrow account so she could bid on any house on Nov. 2, 2014, three months prior to the sale, McClendon said. He added that she entered her account and routing numbers for the electronic check, which he said would have been "something very difficult to do by someone affected by prescription medication."

"The diet pill seems like a convenient excuse for not doing their research before bidding," McClendon said.

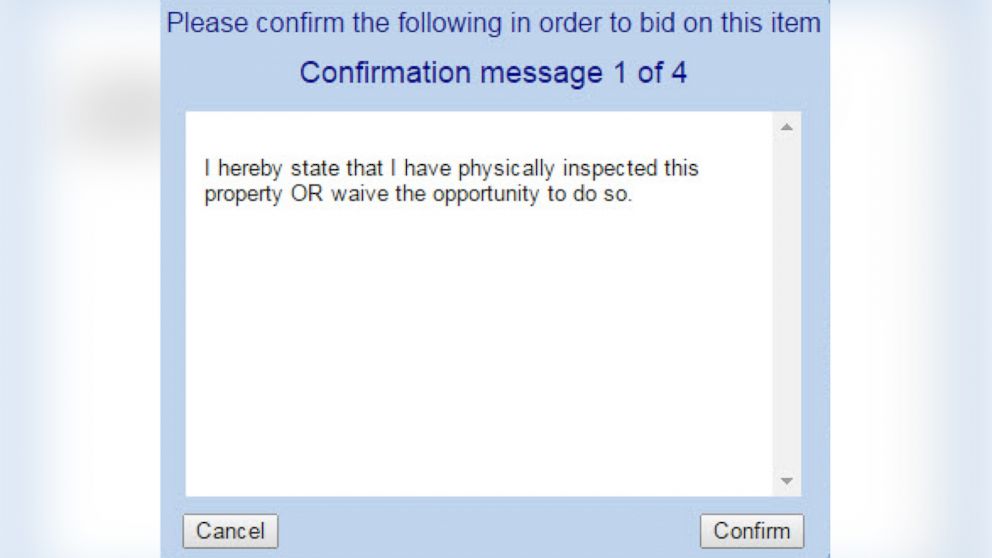

McClendon points out that McKaig doesn't allege that the auction site doesn't work as intended. McKaig also bid on several other properties throughout the month, confirmed the mandatory bidder acknowledgements and placed several other bids on the day of the sale, McClendon said. The website asks bidders to confirm by checking statements such as, "I hereby state that I have physically inspected this property or waive the opportunity to do so."

McClendon said many investors will purchase a foreclosed property to rent it out before the foreclosure is completed.

The price that McKaig is paying for the home only pays off the homeowner association debt, according to the Sentinel, while Chase Mortgage has a $400,000 lien on the house that she would be responsible for paying.

McKaig's attorney Rich Weinman declined to comment to ABC News and stated that she also declines to comment. The Belmere Homeowners Association did not respond to a request for comment.

A notice of hearing has been set for April 16, according to the Orange County Clerk of Courts. A judge could either let the case stand and McKaig would be forced to make good on her commitment to purchase the house; or a judge could vacate the sale, returning McKaig's money so that the property may be re-auctioned.