How flat-fee maternity care can cut costs

This is a Kaiser Health News story.

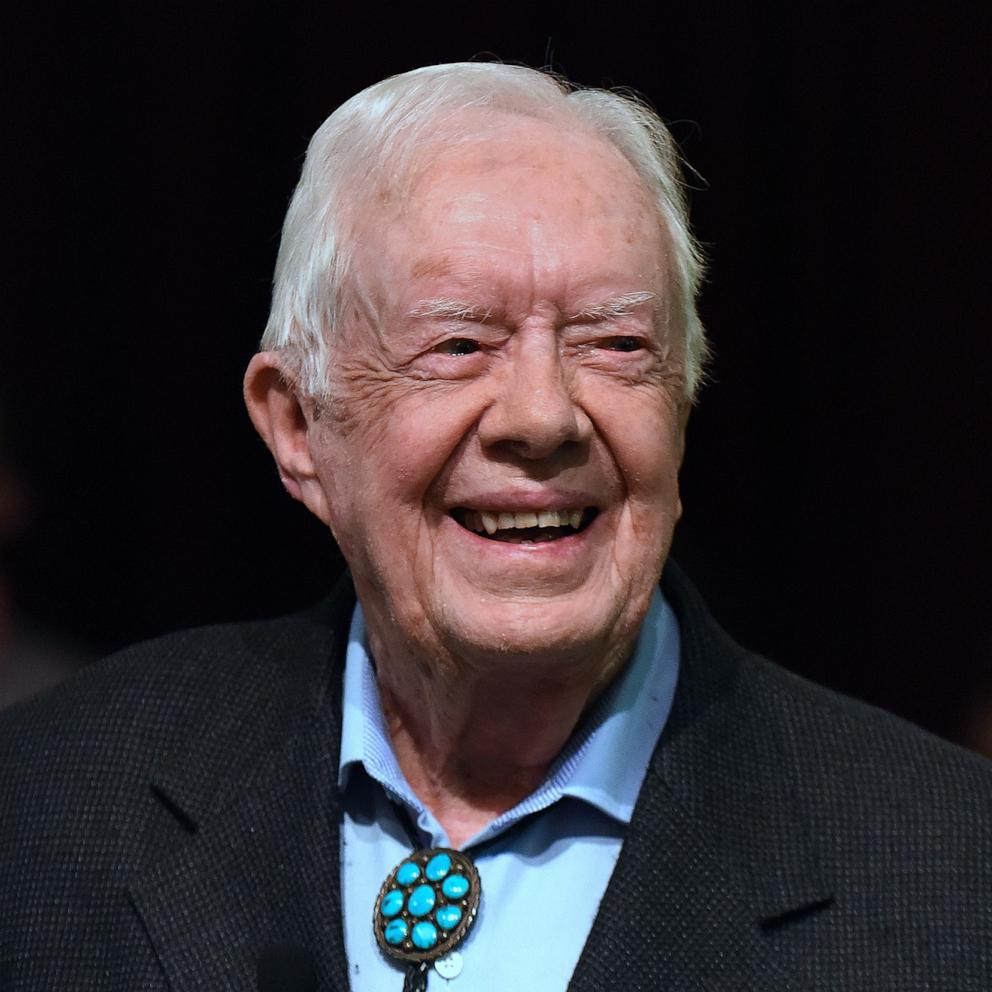

The thrill of delivering newborns helped pull Dr. Jack Feltz into the field of obstetrics and gynecology.

More than 30 years later, he still enjoys treating patients, he said. But now, Feltz is also working to change the way doctors are paid for maternity care.

Feltz’s New Jersey-based practice, Lifeline Medical Associates, recently partnered with the insurer UnitedHealthcare to test a new payment model. The insurer sets a budget with the practice to pay doctors one lump sum for prenatal services, delivery and 60 days of care afterward. If the costs come in below that amount, the medical practice gets to keep some of the savings. (Hospitals aren’t a part of this contract; the insurer pays them separately for their services.)

“We’ve always been taught to take care of patients as if they were our mothers and our daughters,” said Feltz, who also leads a coalition of obstetricians called the U.S. Women’s Health Alliance that advocates for high-quality, affordable care. “But now we have to take care of our patients as if they were our mothers and our daughters, and as if it was our money.”

This new program, announced in May, is a first step by the insurer to bundle physician payments for maternity care into a single flat fee that covers all care and procedures. A handful of insurers and state Medicaid programs are experimenting with similar models, sometimes incorporating hospitals and other health providers as well.

By moving from paying for maternity care in a piecemeal way to relying on bundled payments, insurers and doctors say they hope to cut costs and improve the quality of care for pregnant women. The lump sums are also seen by doctors and insurers as a possible way to improve outcomes, including driving down the number of cesarean sections in the United States.

About one-third of all deliveries in the U.S. occur through C-sections, even though the World Health Organization estimates they are medically required in only 10% to 15% of births. The rate varies dramatically among individual hospitals.

These surgeries can increase the risk of infections or other medical problems for the mother and baby. And they are more expensive than a vaginal delivery.

“The way we’ve been doing things is just not justifiable,” said David Lansky, a senior adviser at the Pacific Business Group on Health, a San Francisco-based coalition of private and public organizations that collectively purchase health care for 10 million Americans. “The shift we’re talking about is to say someone is accountable for all the care that needs to be provided to support a family through this experience.”

The professional association that represents obstetricians, however, is approaching the new payment strategy with caution because it could expose doctors to financial risks.

And even fans of such a model acknowledge there are still significant obstacles to be worked out before this sort of flat-fee system could be implemented broadly.

The bundled-payment model is relatively new in maternity care, and its structure can differ by insurer. Some insurers could pay a single amount to one doctor, who uses that to cover the hospital care. Other plans can opt to negotiate a separate contract with the hospital. Insurers can choose to pay doctors before or after patients receive services. The length of care, eligibility and services included in the bundle can also vary.

Patients generally are not even aware their care is being handled under a bundled payment.

In traditional coverage, insurance payments for some women are delivered as bundled payments for portions of their prenatal care, said Suzanne Delbanco, executive director of Catalyst for Payment Reform, an organization that helps advise employers and other organizations that buy health coverage. However, the latest version is different because insurers are adding quality measures that increase accountability and additional services, such as delivery costs, to the bundle.

UnitedHealthcare began testing the option with Feltz’s practice and another in Texas. The insurer said it hopes to expand to as many as 20 practices by the end of the year. Cigna and Humana are also piloting bundled maternity care programs. A few Medicaid programs, including those in Arkansas, Ohio and Tennessee, have experimented with it.

Expanding the rarely used model to include maternity care could represent a major shift in health care finance. Births were the most common cause of hospitalizations among patients discharged in 2016, according to government data.

“Maternity care is kind of the sleeper of health care services,” said Dr. Neel Shah, an assistant professor of obstetrics, gynecology and reproductive biology at Harvard Medical School.

The pivot in payments is being made as the quality of maternity care in the United States comes under renewed scrutiny. An estimated 700 women in the U.S. die each year because of pregnancy-related complications, the federal Centers for Disease Control and Prevention reported. The rate of deaths in the U.S. is worse than that of many other affluent countries, NPR and ProPublica reported in 2017.

And C-sections cost more. In the Denver area, for instance, the average vaginal delivery costs $7,716 while the average C-section costs $14,274, according to 2019 data from the Health Care Cost Institute. On average, commercial and Medicaid insurers pay 50% more for C-sections than for vaginal deliveries, according to a 2013 report by Truven Health Analytics, a health industry consulting group.

Lansky’s group tested bundled payments for births in 2014 in Southern California. According to their report, the rate of C-sections in first-time, low-risk pregnancies dropped by nearly 20% in less than one year among the first three participating hospitals.

However, some of the bundled-payment models fall short of aspirations. Tennessee saved money in 2017 after adopting the payment model for Medicaid beneficiaries. But the rate of C-sections remained unchanged, according to a report by the Medicaid and CHIP Payment and Access Commission (MACPAC), a nonpartisan advisory group for Congress.

In Ohio, where the Medicaid program covered complicated pregnancies as well as those that were low-risk, bundling payments into a lump sum for OB-GYNs cost the state more than expected, the advisory group found.

Bundling raises other concerns, too. Because some bundled-payment programs assign the total cost of care to a single physician, the financial burden falls on that physician. Dr. Lisa Hollier, the immediate past president of the American College of Obstetricians and Gynecologists, is concerned that these models may discourage team-based care.

If the physician providing prenatal care overlooks a problem that a different doctor must treat during delivery, for example, it wouldn’t be fair for the OB-GYN delivering the baby to bear the financial burden, Hollier said.

How payers define a low-risk pregnancy is also unclear, she said. If the target price for the suite of services in the model is not risk-adjusted for the cost of treating conditions like gestational diabetes, she said, doctors could be penalized for treating these patients.

Gestational diabetes occurs in up to 10% of pregnancies in the U.S. annually, according to the CDC, and patients with the condition need additional tests, checkups and insulin.

Julianne Pantaleone, national director of bundled payments and strategy at UnitedHealthcare, said the insurer, as it works through its pilot program, will not penalize physicians for providing care beyond the initial budget.

The lack of robust data systems built for bundled payments also poses a potential barrier to successfully adopting the model, said Blair Barrett Dudley, a senior manager at the Pacific Business Group on Health.

Insurers and doctors need real-time data to ensure they are meeting the model’s quality measures. However, these information banks are expensive to build, Dudley said, and many of the existing ones aren’t structured for this payment structure.

Feltz agreed that getting such data will be imperative to a successful bundled payment program. Without the information, he said, “it’s like launching a ship and not knowing where it’s going to go.”

Kaiser Health News is a nonprofit news service covering health issues. It is an editorially independent program of the Kaiser Family Foundation, which is not affiliated with Kaiser Permanente.