Black business owners must overcome obstacles to have a chance at building wealth

Josephine Bolling McCall was only 5 years old when her father was killed in 1947 in a brutal lynching on the side of the historic U.S. Route 80 in Lowndes County, Alabama. She says she’ll always remember seeing him lying dead at the fork of the road.

“In Lowndes County, which was known as ‘Bloody Lowndes,’ if a white man wanted a girl that a Black boy was dating, he simply killed the boy,” McCall told “Nightline” co-anchor Byron Pitts. “I was told that Black bodies were … strewn alongside the highway every weekend.”

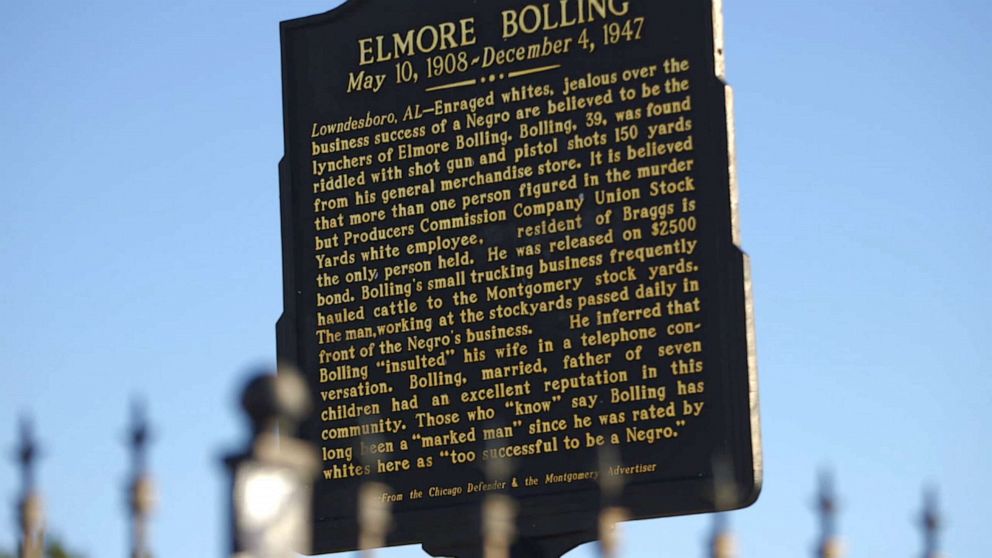

McCall, however, says white men in Lowndes killed him for something else: his business success.

She said her father owned a farm where he had about 40 Black employees. He had milk trucks, she said, that had been specifically designed to pick up milk. Her mother would also sell food out of their truck. As a Black man in 1940s Alabama, her father had created different revenue streams in hopes of growing his family’s wealth.

“He had moved himself out of the societal class that we Blacks were supposed to be in,” McCall said. “He had acquired material goods that put him above his place. So he was killed because he was out of his place and deemed to aspire to go higher. … [He was] too prosperous to be a Negro.”

Watch the full story on "Nightline" TONIGHT at 12:35 a.m. ET on ABC.

Bolling was one of an unknown number of successful Black entrepreneurs during the Jim Crow era who built their success in pockets across the country, including Tulsa, Oklahoma; Rosewood, Florida; and Bronzeville, Illinois.

Like Bolling, however, their success was targeted; some encountered violent confrontations. Others faced discriminatory laws and informal practices that hindered opportunities -- obstacles that still exist today. Many of the descendants of these business owners are still trying to bounce back from the lasting impact of these injustices.

“At the time of my father’s death, he had $40,000 in the bank in Montgomery, [Alabama],” McCall said, adding that she tries not to remember the value of that amount today. “But the white people took the money from us. Back then, you did not dispute a white man.”

It’s estimated that Bolling was worth up to $500,000 when accounting for inflation. His family said that white debt collectors fraudulently claimed they were owed money after his death and took all of it.

To commemorate her father, in 2007, the Bolling family erected a historical marker near where he died, 150 yards from where his general merchandise store was located.

“He was not accused of a crime -- had not committed a crime,” McCall said. “And yet, murdered for being successful, leaving seven children and a wife.”

One man was arrested following Bolling’s death, but the charges were later dropped by a grand jury. When asked if she ever wonders about what happened to those men involved in her father’s death, she said she once had the opportunity to meet the accused man’s daughter.

“I did not do that,” she said. “I did not think I could … I guess, upset her, not knowing who she was. … I did not know enough about the circumstance to infringe on her rights as a human.”

McCall said her family fell into poverty after her father’s death. Her oldest brothers dropped out of school and found jobs and her mother started working at a dry cleaner, she said. Today, the Bollings still have not acquired half the wealth Elmore Bolling had built.

Wealth disparities between Black and white Americans persist. In 2019, the median white family held nearly eight times the wealth of the typical Black family, according to the Brookings Institute.

“You have to have some generational wealth in order to move up the ladder,” McCall said. “So when you’re cut down from the bottom with nothing to build on, and that’s basically where Black people are, you have nothing to build on.”

Like her father, McCall said that generational wealth should be built through “our intellect and amount of work we put into something.”

“We do not want handouts,” she added. “That would be the last thing. My father believed in work. He had strong work ethic.”

Seven hundred miles north, in Richmond, Virginia, the membership-based Jackson Ward Collective is working to connect Black-owned businesses to the resources they need to reach success. In what was once the capital of the Confederacy, the Jackson Ward district had become a center for Black wealth at the turn of the 20th century.

“Jackson Ward was once considered the birthplace of Black capitalism,” said Melody Short, a co-founder of the organization.

“There was always good eating in Jackson Ward,” co-founder Kelli Lemon added. “That is where entertainment was. I know that some of the richest Black Americans got their start in Jackson Ward.”

However, by the 1960s, much of the historically Black district fell into ruin as residents faced mounting obstacles.

“Many of the things that we associate with thriving communities, like running water, sewer systems, plumbing, cleanliness [and] trash collection, were all neglected,” said Julian Hayter, a historian and professor at the University of Richmond. “Public officials built what was then the Richmond Petersberg Turnpike … which leveled roughly 730 homes.”

Hayter said residents also faced redlining, “a risk assessment system that in effect designated particular areas based on whether or not they were worthy to receive loans.”

“Green and blue areas were generally given the green light for development -- almost exclusively white areas -- whereas red and yellow areas … were predominantly African American, Jewish, poor whites, Latinx,” he said.

Rasheeda Creighton, another co-founder of the organization, said there are still limitations to the size of a loan a Black person can get.

Shantelle Brown, Pharm. D., is a member of the Jackson Ward Collective and owner of HOPE Pharmacy in Richmond. She says the biggest issue she faced with opening up the pharmacy was securing capital.

“They didn’t see that I would be able to obtain the prescription growth, the finances to pay them back,” Brown said of the banks she sought loans from. “They didn’t see it just based on the area that we were in.”

She went on, “The amount that I was asking for, I had more than that in the assets that I had and so, in looking at that, that often makes me think, maybe they just did not want to take that chance on me. Maybe, because of the color of my skin.”

Even though her pharmacy has proven itself essential to the area during the COVID-19 pandemic -- she’s even been providing the COVID-19 vaccine -- Brown worries about funding for the long-term.

Short says that in order for there to be a level playing field for Black Americans, there needs to be equity in business, land and real estate ownership.

McCall, who has dedicated her life to education, is now turning the 1800s-era single-room school that she once attended into a museum and adult learning center in honor of her father.

“I’ve been the first Black in a lot of circumstances,” she said. “First Black [physical education] teacher -- a couple of times -- first Black administrator … first Black president of the Alabama Association of School Psychologists. Being the ‘first Black,’ you learn that you’re not making it because you’re the ‘first Black.’ You’re making it because you have certain attributes and you can do certain things, and that’s been fulfilling.”

When asked what her father would think about her today, McCall said he’d be “proud.”

“I wish I had the business sense that he had,” she said, “but I do have the fortitude.”