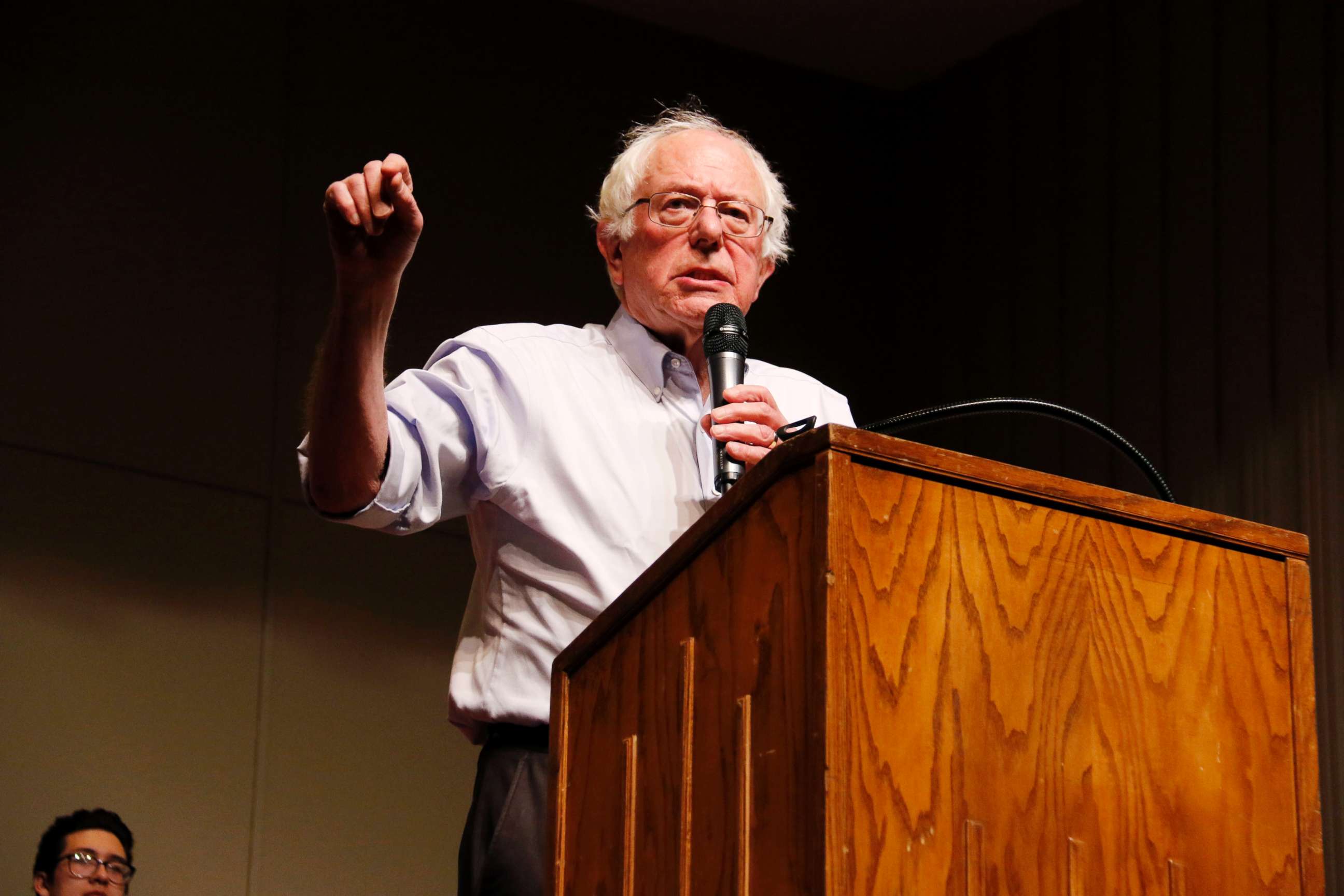

'Too big to fail, too big to exist': Bernie Sanders takes aim at banks with new bill

Bernie Sanders introduced a bill to break up America's largest financial institutions on Wednesday, exactly 10 years after President George W. Bush signed the government's big bank bailout program into law.

"Wall Street cannot continue to be an island unto itself gambling trillions of other people’s money on risky derivatives, acting illegally, and making huge profits, all the while assured that if their schemes fail the taxpayers will be there to bail them out," Sanders said in a statement Wednesday evening.

"If a bank is too big to fail, it is too big to exist," he added. "When it comes to Wall Street reform, that must be our bottom line."

To that end, the Vermont senator introduced the "Too Big to Fail, Too Big to Exist Act" with California Democrat Rep. Brad Sherman on Wednesday.

The bill states it would dismantle the nation’s six largest banks -- JP Morgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley -- and other financial institutions with total assets greater than 3 percent of the U.S. GDP, or about $584 billion.

"No financial institution should be so large that its failure would cause catastrophic risk to millions of Americans or to our nation’s economic wellbeing," Sanders said in his statement. "No financial institution should have holdings so extensive that its failure would send the world economy into crisis."

The Financial Services Forum, which represents America’s eight largest banks, responded to the bill in a statement.

"The banking industry and governments around the globe have made enormous strides during the past decade to ensure that large banks are safe and sound and that no institution is too big to fail," Financial Services Forum President and CEO Kevin Fromer said Wednesday, citing recent industry and regulatory changes.

"Policymakers must neither ignore the progress that has been made nor the essential role of large financial institutions in our economy," Fromer added.

The four banks mentioned in Sanders' bill pointed to Fromer’s statement when asked to comment on the proposal.

Sanders correlated the bill’s introduction with the 10-year anniversary of the Troubled Asset Relief Program (TARP), which allowed the government to bail out major banks in the wake of the subprime mortgage crisis.

President George W. Bush signed TARP into law on Oct. 3, 2008, saying it would keep the banks afloat and stave off a potential global economic crisis.

Major U.S. banks are even bigger now than they were in 2008, Sanders said, adding that the four largest banks are now about 80 percent larger than they were before the government’s billion-dollar bailout. Sanders and Sherman said large banks haven't done enough prevent another meltdown like the one seen in 2008.