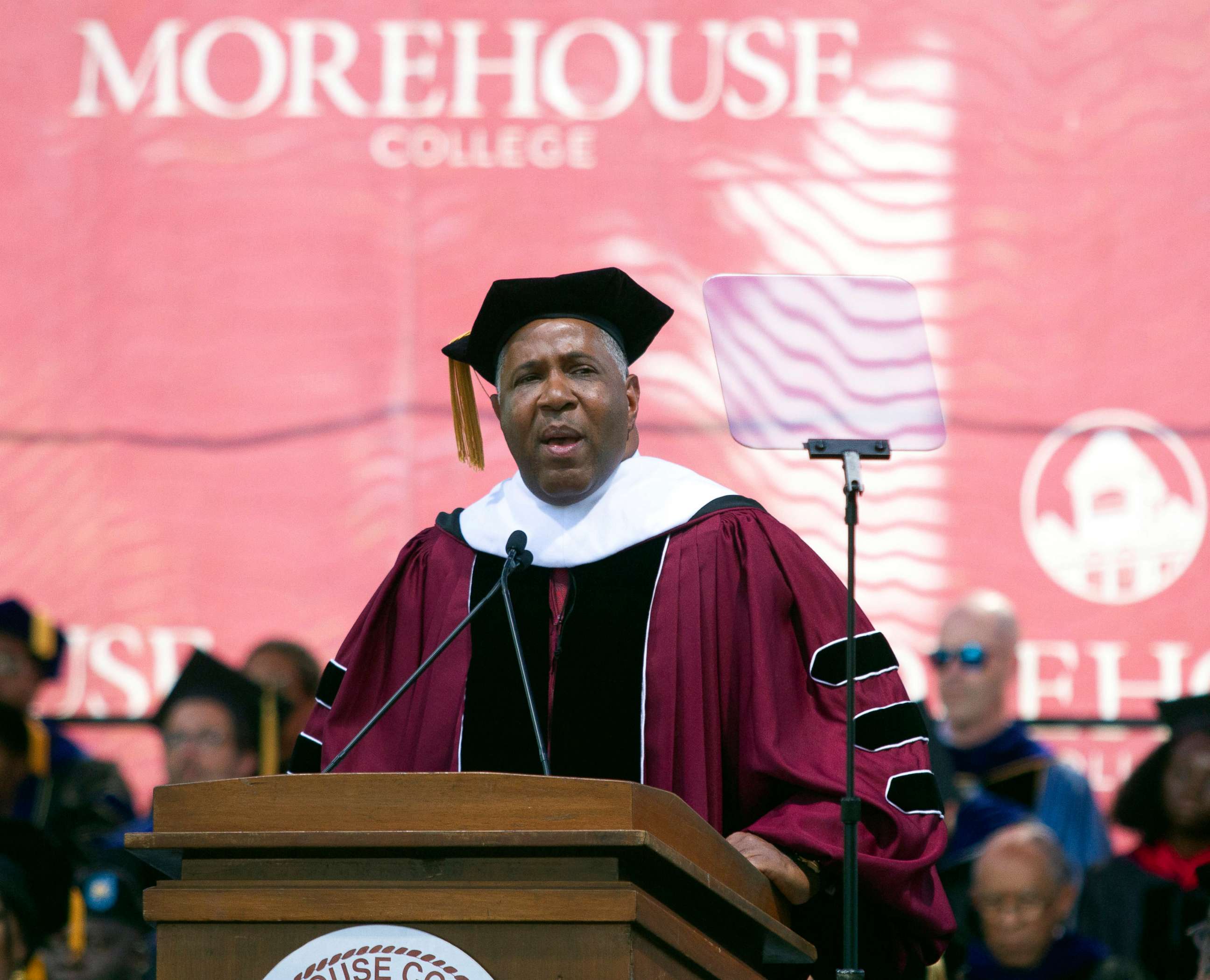

If you're not a lucky 2019 Morehouse grad, here are strategies to approach student debt

The nearly 400 graduates of Morehouse College who received a life-changing surprise Sunday when their commencement speaker promised to pay off their student loans recognize how lucky they are.

"Even graduating from Morehouse was a tremendous blessing," said graduate John Jacob Burns, who said he $35,000 in student loans. "To get all my debt paid off after that ... that was like something I couldn't even imagine."

The pledge from billionaire Robert F. Smith to the graduates of the historically black, all-male college in Atlanta is estimated to cost him $40 million.

The pledge from Smith reverberated far beyond Morehouse’s graduation and went viral on social media, with people applauding him for his generosity.

Smith’s donation, though generous, also shows the scope of the student debt crisis in the U.S. The estimated $40 million pledge would erase the debt from just one graduating class of 396 students.

There are around 18 million college students in the U.S. attending more than 4,000 colleges and universities, according to U.S. Census data.

America’s total student loan debt is now around $1.5 trillion.

Two-thirds of college seniors who graduated from public and private nonprofit colleges in 2017 had student loan debt and they borrowed an average of nearly $29,000, according to the Institute for College Access & Success, a non-profit that works to make higher education more available and affordable.

The average Morehouse College student leaves the college around $30,000 or more in debt, Morehouse President David Anthony Thomas told reporters after the graduation.

If you're not one of the lucky Morehouse graduates to have that debt erased, here are three tips for paying it off from ABC News chief business correspondent Rebecca Jarvis.

1. Consider your future salary

It’s really important to think about what the job is you might hold in the future and to think about the salary and income realistically and say, "Is this truly something that will allow me to pay off my student loans?"

If your debt at graduation is less than your first year’s salary, then you have a pretty good shot at paying it off over the next 10 years, or even less.

But, if your debt at graduation is greater than that first year's salary, it could take you upwards of 20 years to pay it off.

2. Use tax write-offs

It's not some massive benefit that you get, but you can deduct some of your student loan payments.

You should talk to an accountant or look at your tax software and see how you can make those deductions because if you're not taking them, and you're making massive loan payments, you're probably leaving some money on the table that you could be getting back.

3. Plan for retirement

One of the biggest mistakes young people make is putting too much toward their debt repayment and not enough toward their retirement savings account.

If you start putting $100 a month into your retirement account when you're 22 and keep that up for the next 10 years until you're 32, you should have saved about $174,000 by the time you retire.

But if you wait until you're 32 to start putting money into the retirement account and you put in $100 every month until you're 65, which means you put in three times as much money as if you had started early, you would have only have saved about $155,000.

So ultimately, you could put in three times as much money, start later and still have less money in that retirement account when you retire than if you start early.

It really does pay to start earlier and it really does pay not to focus only on your [student] debt, and to make sure, especially if you work at a company that has a matching program, to put in the minimum amount to at least get that money.