How a former financial aid counselor helps students navigate the costs of college

A former college financial aid counselor is helping future generations get excited about college and teaching young people how they can afford it.

“My mission is to create a world of promise and opportunities for students, especially minority students,” Jessica Brown, CEO of The College Gurl Foundation, said.

Her experience as a financial aid counselor at her alma mater, Howard University, inspired her work to help others achieve their college dreams.

“I was seeing so many students go home for minimal balances, $500 and $1,000, and it may be minimal to us, but that's not minimal to somebody who really doesn't have it," Brown, who studied journalism, said. "It would just break my heart that some of these students were unable to financially stay in school.”

Brown wrote a book on the subject, "How to Pay for College When You're Broke," which came out in 2016. It provides strategies families can use to help their children achieve their college dreams, even with a lack of funds.

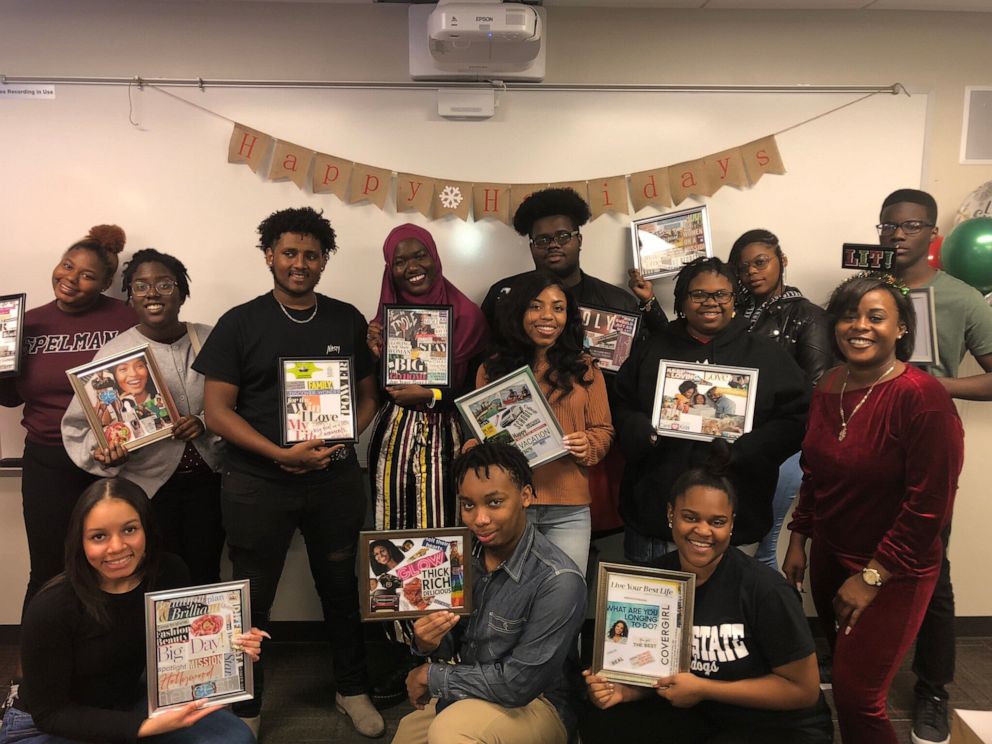

Her nonprofit, The College Gurl Foundation, provides college prep for low-income, first-generation and minority college students.

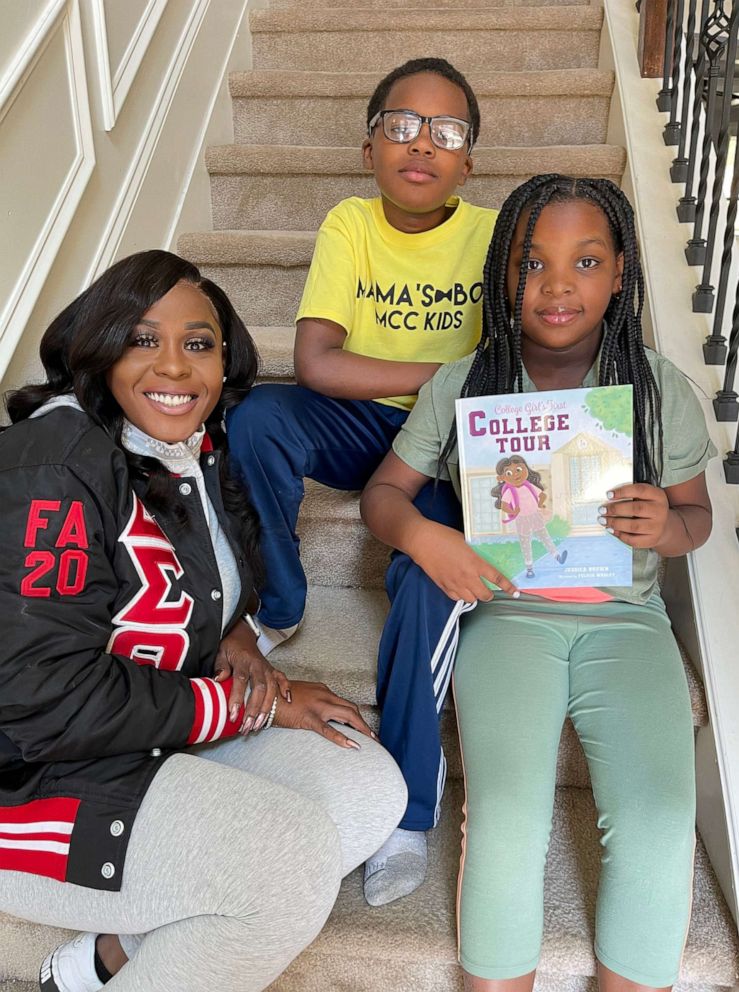

Brown has also expanded her audience with her latest book, "College Girl's First College Tour," which follows a diverse group of elementary school students who take a college tour and learn about different career possibilities.

“I really wanted to show children of all cultures, of all races and disabilities, that college is possible for everyone,” she said.

She added, “I just want people to know that their future is bright. I don't think that we get those reminders or that positive affirmation every day to remember that, but as long as you are willing to work for it, it will happen; college is possible. Anything is possible.”

Brown said the most important thing families can do is prepare for the cost of college early.

“They wait until the last minute, once they get accepted," she said. "If you're accepted in March, you only have April, May, June and July to figure it out.”

She went on, “You should be on it. There should be no excuses. Every year, hundreds of thousands of dollars in scholarship money goes unclaimed, so there's a lot of money out there.”

Here are Brown's five tips families can follow to prepare for the cost of college.

1. Family financial planning

“Just talking about college as a family, really getting to understand your child and their needs and what they're looking for in a college.”

2. Fill out the FAFSA form early

“Financial aid is known as first come, first serve, so the faster you get it in, the better. Additionally, if you fill out the Free Application for Federal Student Aid package early, you know exactly how much money you still need and have more time to figure out how you will pay for the rest.”

3. Don’t be afraid to take out a loan if necessary

Brown said many fear taking out a loan and steer away from the process altogether. “Nobody wants to borrow a loan. But the reality is sometimes we have to. If you do decide to borrow, use a student loan.”

4. But only use what you need

“If you know that you need only $2,000 or $3,000, there's no need to borrow $25,000,” Brown said.

5. Use federal loans

“[Federally backed student loans] have a fixed interest rate," Brown said, adding, "They're a little bit more flexible with their payment plans.”