Father of 2 pays off $23k in debt with help from finance podcast

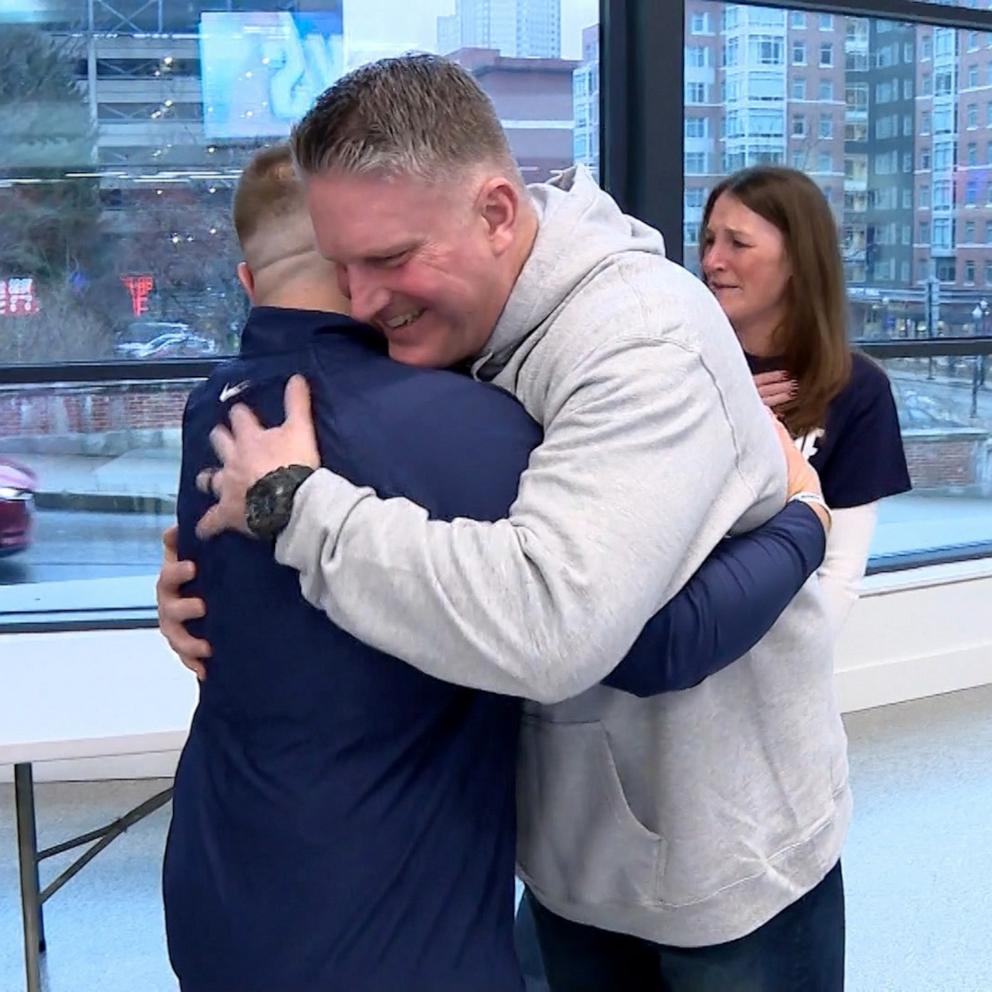

Like many Americans, Jesse Manzo, a father of two, was struggling with debt.

In 2017, Manzo had accumulated $23,000 in debt. And bills from his credit cards, high interest rate loans, car payments and a mortgage seemed never ending. He also didn’t know what he was doing wrong.

“I was just grasping at straws, trying to figure something out, trying to figure out a way to get out of the same mistakes,” Manzo told “Good Morning America.” “It was let’s see where I can hustle up some money.”

For as long as he can remember, Manzo said that his problem with money began when he was young. As a son of immigrants, he didn’t learn about managing money from his family.

“We didn’t really learn much about finance in my family growing up, I didn’t know what a credit report was, I had no idea what collections were or anything like that,” said Manzo. “I think they [my parents] came over to this country and all they did -- they just wanted to survive. So it wasn’t about being rich. It wasn’t about having a strong credit profile.”

Over the years, Manzo said that his debt grew as he kept signing up for more and more credit, but never paying it off completely -- a “recipe for disaster,” he called it.

But Manzo’s wake up call finally came when he received an unexpected paycheck. At the time, Manzo was working extra hours thinking that his next paycheck would help him get out of debt, but when his paycheck came, all he was left with was $11 after money was automatically distributed to the debt he already owed.

“You make so many little mistakes that you don’t understand the ramifications until you know,” he said. “Until you need a place [to live] and no apartment complex will take you because you don’t have the credit for it.”

Manzo said he decided to make a change and when he did, he discovered the “Bad With Money” podcast, which is hosted by finance guru Gaby Dunn, who uses her own experience paying off nearly $70,000 in student loan and credit card debt to help others.

Through Dunn’s podcast, Manzo said he was finally getting the finance lesson he needed years ago.

“I learned about credit card interest rates and how they add up over time and how buying something that is one hundred dollars could end up costing you,” he said.

Like Manzo, Dunn said that her family never discussed money when she was growing up either.

“My parents didn’t really talk to me about money,” said Dunn. “I think a lot of times people think that their children aren’t paying attention or they think that the kids don’t understand so they don’t bother to explain money to them.”

“They don’t bother to explain taxes or how to fill out a check or you know, budgeting or anything to children because they think, ‘well, they’re kids. They’re not going to understand it anyway,’” she added. “But it does lead to a lot of confusion especially as the kid goes into college or starts their first job or whatever and they’re like, ‘I have no basis for this. I have no basic knowledge.’”

After tackling her debt head on, she wanted to teach others through her podcast to tackle their debt too.

Now, with her help, Manzo says he is less than a thousand dollars in debt. He’s also trying to teach his kids about money.

“Teach your kids finance. Teach them the importance of credit. Teach them the importance of utilization,” he said. “Because if you respect money … it’s limitless what you can do with your life.”

Here are some of Dunn’s top tips for paying off debt:

1. Confront your debts

“I wrote out what all of the debts were. So I wrote out every credit card and what it was. I wrote out every student loan and what it was. And then I put them in order of interest,” said Dunn. “Whatever loan you took out that has the highest interest, tackle that one first.”

2. Assess your spending

“I printed out my bank statement and I went through them with a highlighter and I highlighted anything that I was confused about or why did I spend that much or what was a recurring payment that didn’t really make sense to me,” she said. “And then if that’s something you’re not spending money on now, that pile of money, what can it go to? It can go to your debt.”

3. Adjust your mindset

“I think we take debt on as a personal failing,” said Dunn. “I think you just have to not beat yourself up, not imagine that you have to be perfect. So even getting started, if you’re beating yourself up, don’t add extra emotional weight to it. It’s just something that has to get done.”