The Weinstein Company to pursue bankruptcy after sale negotiations break down

— -- The Weinstein Company intends to file for bankruptcy after talks on a sale to an investor group apparently broke down, according to a memo obtained by ABC News.

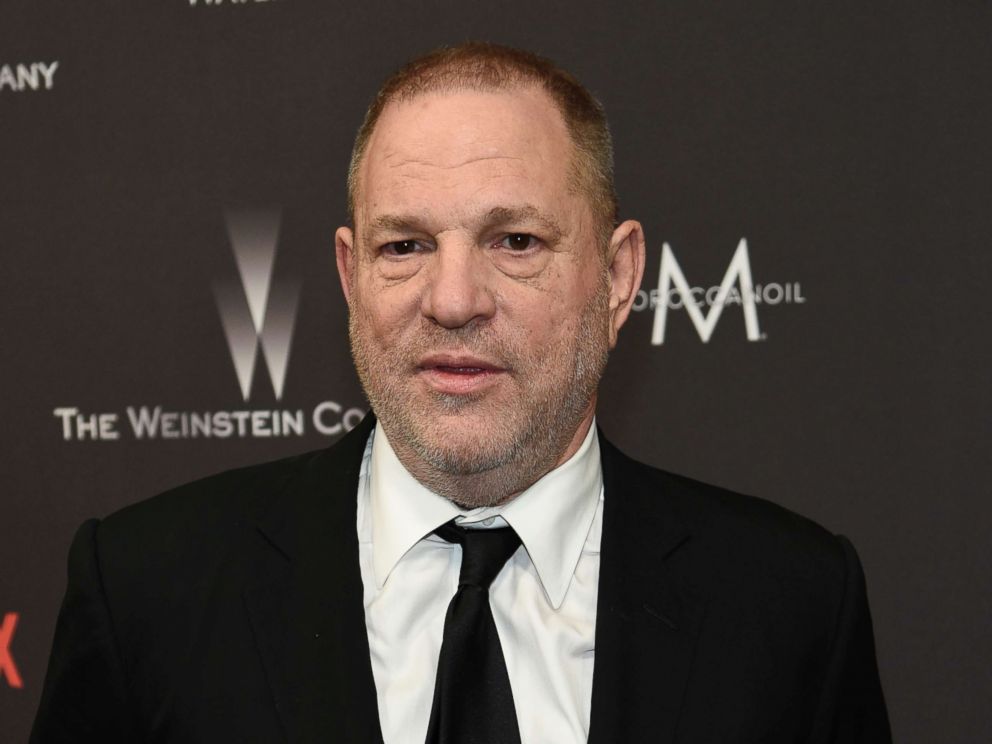

The memo was sent by the company's board to two investors in the group who had been in talks to purchase the entertainment firm co-founded by disgraced producer Harvey Weinstein.

With the breakdown of negotiations, the memo says, the company now must "pursue the Board’s only viable option to maximize the Company’s remaining value: an orderly bankruptcy process."

A meeting with New York Attorney General Eric Schneiderman on Feb. 21, is also referred to in the memo, which claims that both the Weinstein Company and the investor group agreed to meet Schneiderman's specifications for ensuring that alleged victims of Harvey Weinstein's sexual misconduct would be properly compensated if the company sale went through.

A source familiar with the negotiations told ABC News that the purchase deal broke down not over the victims fund, which was set and ready at $90 million, but over the alleged unwillingness of the investors to put in money to sustain the company while a sale was pending.

The company board alleges in the memo, which was addressed to investors Ron Burkle and Maria Contreras-Sweet, that instead of the two sides acting as "partners," the investment group over the weekend sent them "an incomplete document that unfortunately does not keep your promises," which include preserving jobs and keeping the company afloat.

"During this time, we waited patiently for you to deliver the terms you represented would save this Company from certain bankruptcy," the memo said. "[But] there is no provision for necessary interim funding to ensure your future employees were paid; instead, you increased the liabilities left behind for the Company, charting a financial path that will fail."

Contacted by ABC New, the investor group did not comment on the memo or the proposed deal.

The company board's memo continued, "We have believed in this Company and in the goals set forth by the Attorney General. Based on the events of the past week, however, we must conclude that your plan to buy this company was illusory and would only leave this Company hobbling toward its demise to the detriment of all constituents. This Board will not let that happen."

The Weinstein Co. has been looking for an influx of cash and assets ever since Harvey Weinstein late last year became the subject of dozens of allegations by women who claim sexual harassment and assault.

In a statement to ABC News, the New York Attorney General's Office said, "Over the past two weeks, we had very productive discussions with both parties about accomplishing the Attorney General’s goals of compensating victims, protecting employees, and rooting out those who enabled years of sexual abuse at the Weinstein Company. We are disappointed that despite a clear path forward on those issues — including the buyer’s commitment to dedicate up to $90 million to victim compensation and implement gold-plated HR policies — the parties were unable to resolve their financial differences. We will continue to pursue justice for victims in the event of the company’s bankruptcy, and our investigation into the pattern of egregious abuse by Harvey Weinstein and his enablers is ongoing.”

Though Weinstein has admitted to wrongdoing and sought professional help, his spokeswoman has said that "any allegations of nonconsensual sex are unequivocally denied by Mr. Weinstein." Following the claims and news reports, Weinstein was fired from the company that bears his name, banned from the Producer's Guild of America and expelled from the Academy of Motion Picture Arts and Sciences.