With high inflation over the past year and many people looking for ways to keep budgets in check, some are turning to social media as a forum to share and find ideas to save some cash.

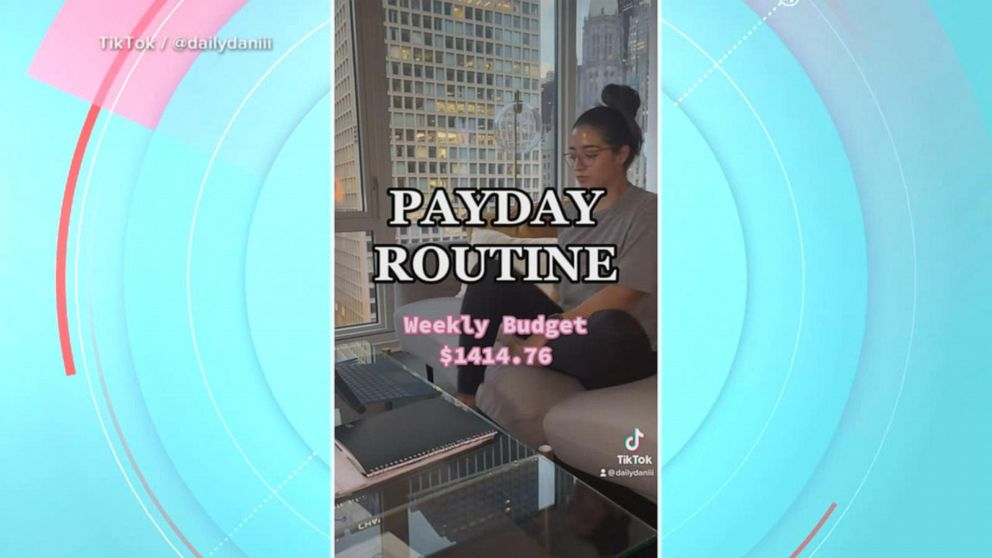

TikTokers like Daniela Martinez and Ana Marcks are among the many online video creators to jump on the latest financial trend and share the breakdown of their payday routine, including breaking down their paychecks, accounting for their bills, daily expenses and even a leisurely day out.

Marcks, known to her followers on TikTok as The Budget Asian, gives users an intimate look at her personal cost of living -- down to the pennies.

"I spent $10.79 on two donuts and a coffee ... [A baseball game] ticket was $18 and I spent $20.36 on these chicken fingers," Marcks shared in a recent video, laying out her day.

For beginner budgeters, Marcks suggested sticking to the 50-30-20 method to best prioritize your needs, wants and savings.

MORE: TikTok parents are spreading the word about Target's generous return policy"Half of your take-home income would be for needs, 30% for wants and then 20% for savings," she explained.

Michael Liersch, the head of advice and planning at Wells Fargo Wealth and Investment Management, told "Good Morning America" that the online trend provides important transparency into the reality of saving money.

"[The trend] really creates this sense of not only social accountability, but it also teaches everyone else about what is actually working and what is actually not working when it comes to people's financial lives," he said.

MORE: Viral kids' social media star Ms. Rachel takes 'mental health' break from TikTokAccording to a March 2023 survey, roughly 60% of consumers reported that they live paycheck-to-paycheck, with 66% of those consumers being Gen Zers.

Marcks said budgeting has brought her a newfound sense of independence.

"I used to spend my money on things I didn't need, and honestly, I wasn't very happy about it," she said. "I feel more in control of not just money, but overall, like who I am. I feel like I have more autonomy."

She added that personal budgeting is often contagious and can benefit more than just one individual.

"Even with my friends, they might want to go to a dinner and I might say, 'It's 50% cheaper to go to a happy hour, can we do that?'" she said. "It's benefited everyone in my life and forced us to become a little bit more creative."